ATTOM: 3Q Mortgage Lending Down at ‘Unusually Fast Pace’

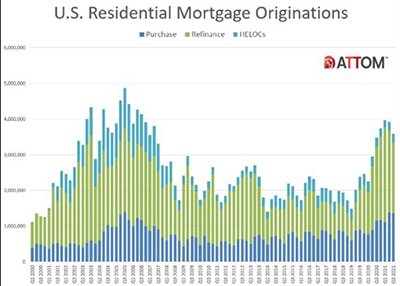

ATTOM, Irvine, Calif., said overall mortgage loan activity fell by 8 percent in the third quarter—the second straight quarterly decrease—as refinance volume faded amid rising interest rates.

The company’s quarterly U.S. Residential Property Mortgage Origination Report said 3.59 million mortgages secured by residential property (1 to 4 units) originated in the third quarter, up 3 percent from a year ago, but down 8 percent from the second quarter– the largest quarterly dip in more than a year.

The quarterly decline also pointed to two unusual patterns developing in the lending industry, said Todd Teta, Chief Product Officer with ATTOM. It marked the first time in more than two years that total lending decreased in two consecutive quarters. More notably, he said, it was the first time in any year since at least 2000 that lending activity declined in both the second and third quarters, which usually are peak buying seasons.

The report said that pattern emerged amid declines in both refinance and purchase lending, which more than made up for a bump up in home-equity lines of credit. Overall, with average interest rates remaining below 3 percent for 30-year home loans, lenders issued $1.15 trillion worth of mortgages in the third quarter, up annually by 11 percent, but down quarterly by 6 percent. The quarterly decrease in the dollar volume of loans was the first since the early part of 2020.

On the refinance side, 1.99 million home loans rolled over into new mortgages during the third quarter, down 13 percent from the second quarter and down 3 percent from a year earlier. The total number of refinance mortgages declined for the second straight quarter, while the quarterly decrease was the largest in three years. Dollar volume of refinance loans fell by 10 percent from the second quarter, to $624.1 billion, although still up annually by 1 percent.

The report noted while refinance mortgages remained a majority of all residential lending activity during the third quarter, that portion dipped to 55 percent, down from 59 percent in both the second quarter and a year ago.

Purchase loans also declined in the third quarter as lenders issued 1.36 million mortgages to buyers, down 2 percent quarterly, although still up annually by 17 percent. Dollar value of loans taken out to buy property dipped to $482.6 billion, down 1 percent from the second quarter of this year but still up 30 percent from a year ago.

Home-equity lending, meanwhile, rose for the second straight quarter, which last happened in mid-2019. Home-equity lines of credit, while down annually by 9 percent, rose 2 percent between the second and third quarters, to 238,500.

Teta said the continued dip in total loan activity during the third quarter represented a growing sign that the nation’s appetite for new home loans is easing – and that the nation’s decade-long housing market boom could even be cooling off.

“The overflow stack of work that was hitting lenders for several years shrank again in the third quarter across the U.S. amid a few emerging trends,” Teta said. “It looks more and more like homeowner’s voracious appetites for refinance deals has eased notably, while purchase lending also dipped. It’s still too early to say if the trends point to major shifts in lending patterns or the broader housing market boom. But the drop-off is significant, especially for home buying, which could suggest an impending housing market slowdown.”

The report said banks and other lenders issued 3,591,794 residential mortgages in the third quarter, down 8.4 percent from 3,922,248 in second quarter but up 3.2 percent from 3,479,655 a year ago. The $1.15 trillion dollar volume of all loans in the third quarter improved by 10.7 percent from $1.04 trillion a year earlier, but fell by 6 percent from $1.23 trillion in the second quarter.

The report also noted the median down payment on single-family homes purchased with financing in the third quarter rose to $27,500, up 5.8 percent from $26,000 in the previous quarter and up 41 percent from $19,502 a year ago. It represented 8 percent of the nationwide median sales price for homes purchased with financing during the third quarter, up from 7.8 percent in the previous quarter and 6.5 percent a year earlier.

Among homes purchased in the third quarter, the median loan amount rose to $295,954, up 2.8 percent from the prior quarter and up 13 percent from a year ago.