Housing Affordability Concerns Intensify

Reports from First American Financial Corp., Santa Ana, Calif., and ATTOM, Irvine, Calif., show rising home prices and inflation are taking a bigger bite out of housing affordability entering the new year.

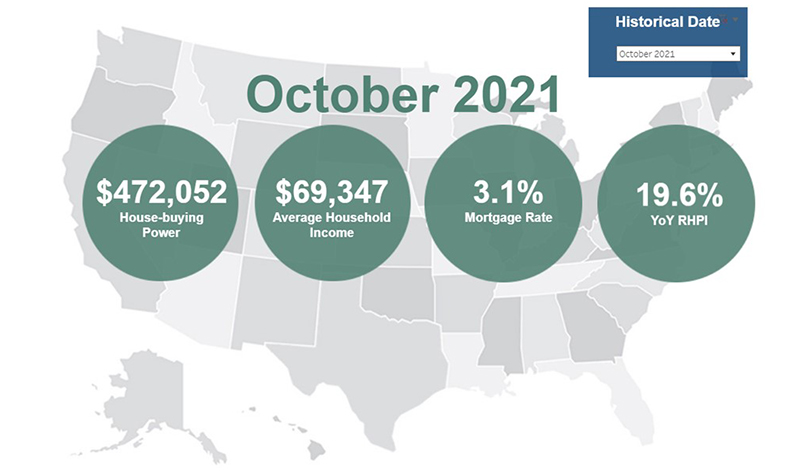

The First American Real House Price Index said housing affordability sank to its lowest level since 2008 in October, as two of the index’s three key drivers swung in favor of reduced affordability from a year ago. Higher mortgage rates and record year-over-year nominal house price growth triggered a nearly 20 percent jump in the index.

The report said real house prices increased by 3.7 percent between September and October and by 19.6 percent year over year. Consumer house-buying power–how much one can buy based on changes in income and interest rates–decreased by 1.7 percent between September and October, but increased by 0.6 percent year over year.

The report noted median household income has increased 3.6 percent since October 2020 and 66.9 percent since January 2000. It said real house prices are 7.0 percent less expensive than in January 2000; While unadjusted house prices are now 39.7 percent above the housing boom peak in 2006, real, house-buying power-adjusted house prices remain 34.7 percent below their 2006 housing boom peak.

“The soaring nominal house prices and uptick in mortgage rates swamped any affordability gains from the 3.6 percent yearly increase in household income,” said Mark Fleming, chief economist at First American. “Affordability declined year over year in all of the markets we track.”

Fleming cautioned if affordability falls too far, some home buyers on the margin will pull back, prompting fewer bidding wars and causing house prices to moderate. In the near term, a labor market characterized by high demand, but limited supply means upward pressure on wages as employers compete to attract employees.

“While mortgage rates are expected to increase in 2022 as the economic recovery continues, consensus expectations still put them below 4 percent,” Fleming said. “For some home buyers, as the ‘big short’ in housing supply continues, it will become impossible to keep up with double-digit nominal house price growth, especially in a rising-rate environment. The challenge for home buyers in 2022 will mirror 2020 and 2021 – you can’t buy what’s not for sale even if you can afford to.”

The report said states with the greatest year-over-year increase in the index were Arizona (+32.7 percent), Florida (+25.9), South Carolina (+25.9 percent), Georgia (+24.8 percent) and Nevada (+23.7). No states saw a year-over-year decrease. Among major metros tracked by First American, markets with the greatest year-over-year increase were Phoenix (+33.7 percent), Charlotte, N.C. (+32. 3), Tampa, Fla. (+30.9 percent), Jacksonville, Fla. (+29.3 percent), and Memphis, Tenn. (+27.5 percent).

In its fourth quarter U.S. Home Affordability Report, ATTOM reported median-priced single-family homes are less affordable in the fourth quarter compared to historical averages in 77 percent of counties across the nation, up from just 39 percent a year ago, to the highest point in 13 years, as home prices continue rising faster than wages throughout much of the country.

The report said median home prices in 440 of the 575 counties analyzed in the fourth quarter are less affordable than past averages, up from 428 in the third quarter and 224 a year ago – an increase that has continued as the median national home price has shot up 17 percent over the past year to a record high $317,500.

The report said this pattern – home prices still manageable but getting less affordable – has resulted in major ownership costs on the typical home consuming 25.2 percent of the average national wage of $65,546 in the fourth quarter, up from 24.4 percent in the third quarter and 21.5 percent a year ago. Still, the latest level is within the 28 percent standard lenders prefer for how much homeowners should spend on mortgage payments, home insurance and property taxes.

“The average wage earner can still afford the typical home across the United States, but the financial comfort zone continues shrinking as home prices keep soaring and mortgage rates tick upward,” said Todd Teta, chief product officer with ATTOM. “Historically low rates and rising wages are still big reasons why workers can meet or come very close to standard lending benchmarks in a majority of counties we analyze. But the portion of wages required for major ownership expenses nationwide is getting closer to levels where banks become less likely to offer home loans. Amid very uncertain times, with the pandemic again threatening the economy, we will keep watching this key measure of housing market stability.”