MBA November Builder Applications Survey Down 3% From October; 2.2% from Year Ago; Home Builder Sentiment Up

Mortgage applications for new home purchases fell in November by 3 percent from October and by 2.2 percent from a year ago, the Mortgage Bankers Association reported Thursday.

The MBA Builder Applications Survey reported by product type, conventional loans composed 76.3 percent of loan applications, FHA loans composed 13.2 percent, RHS/USDA loans composed 0.5 percent and VA loans composed 10 percent. The average loan size of new homes increased from $412,339 in October to $414,114 in November.

“Applications to purchase new homes in November slightly declined on a monthly and annual basis,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “However, the average loan amount increased to a new record of $414,114. A competitive purchase market, combined with increased building materials costs, have been pushing sales prices higher. There also continues to be a shift to the higher end of the market, which is also contributing to the higher loan amounts.”

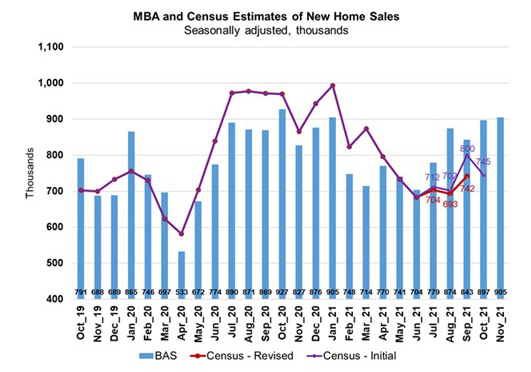

Kan noted home sales had a strong month with more homebuyers choosing newly built homes. “Home sales edged higher over the month to the strongest annual pace since January 2021 at 905,000 units, as limited for-sale inventory has driven more demand to the new home segment,” he said. “MBA’s November estimate for new home sales is the largest for the month since the survey began in 2012.”

MBA estimated new single-family home sales at a seasonally adjusted annual rate of 905,000 units in November, based on data from the BAS, an increase of 0.9 percent from the October pace of 897,000 units. On an unadjusted basis, MBA estimated 65,000 new home sales in November, a decrease of 4.4 percent from 68,000 new home sales in October.

The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The MBA Builder Applications Survey tracks application volume from mortgage subsidiaries of home builders across the country. Using these data, as well as data from other sources, MBA provides an early estimate of new home sales volumes at the national, state and metro level. These data also provide information regarding types of loans used by new home buyers. Official new home sales estimates are conducted by the Census Bureau on a monthly basis. In those data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application.

For additional information on the MBA Builder Applications Survey, click here.

In a separate report Wednesday, the National Association of Home Builders said builder confidence matched its highest reading of the year in December despite inflation concerns and ongoing production bottlenecks.

The NAHB/Wells Fargo Housing Market Index builder confidence edged higher for the fourth consecutive month on strong consumer demand and limited existing inventory. Builder sentiment in the market for newly built single-family homes moved one point higher to 84.

The HMI index gauging current sales conditions rose one point to 90 and the gauge charting traffic of prospective buyers also posted a one-point gain to 70. The component measuring sales expectations in the next six months held steady for the third consecutive month at 84.

Regionally, the Northeast rose four points to 74, the Midwest posted a two-point gain to 74 and the South and West each posted a three-point rise to 87, respectively.

“The most pressing issue for the housing sector remains lack of inventory,” said NAHB Chief Economist Robert Dietz. “Building has increased but the industry faces constraints, namely cost/availability of materials, labor and lots. And while 2021 single-family starts are expected to end the year 24% higher than the pre-Covid 2019 level, we expect higher interest rates in 2022 will put a damper on housing affordability.”

“Traffic likely was boosted by unseasonably mild weather and buyers trying to stay one step ahead of the Fed,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Demand has not been a problem for builders, and that is what the HMI primarily measures. The greater challenges for builders are on the operational side, where persistent shortages of building materials, workers and lots continue to limit construction and extend project timelines. Pricing is also more difficult because material prices have increased dramatically and remain volatile. Despite these challenges, many of the public builders have reported strong operating margins.”