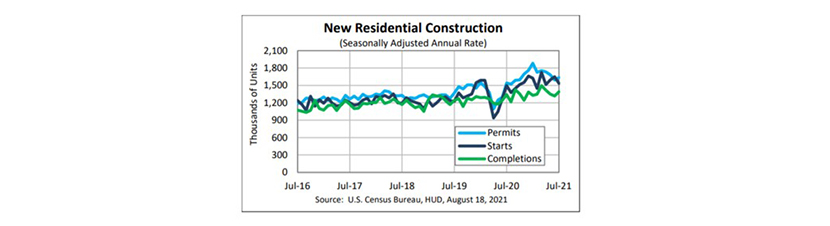

July Housing Starts Fall 7%

(Chart courtesy U.S. Census Bureau.)

July housing starts fell by 7 percent, the Census Bureau reported yesterday, a disappointing result as home builders continue to be hamstrung by pipeline and labor shortages.

One sign of optimism, however: building permits jumped by a 3 percent, signaling an uptick in starts later this year.

The report said privately owned housing starts in July fell to a seasonally adjusted annual rate of 1,534,000, 7 percent below the revised June estimate of 1,650,000, but 2.5 percent higher than a year ago (1,497,000). Single‐family housing starts in July fell to 1,111,000, 4.5 percent below the revised June figure of 1,163,000. The July rate for units in buildings with five units or more fell to 412,000, down by 13.6 percent from June and by 16.3 percent from a year ago.

Regionally, results were mixed, with only the South, the largest region, showing improvement. Starts in the South rose by 2.1 percent in July to 889,000 units, seasonally annually adjusted, from 871,000 units in June. From a year ago, starts rose by 5.2 percent.

In the West, starts fell by 11.3 percent in July to 384,000 units, seasonally annually adjusted, from 433,000 units in June but improved by nearly 24 percent from a year ago. In the Midwest, starts fell by nearly 7 percent to 188,000 units in July from 202,000 units in June and fell by 10.5 percent from a year ago. In the Northeast, starts fell by 49.3 percent in July to 73,000 units from 144,000 units in June and fell by nearly 45 percent from a year ago.

Despite the downbeat numbers, Mike Fratantoni, Chief Economist with the Mortgage Bankers Association, said there was much to like in the report.

“Both single-family and multifamily starts declined in July relative to June, but single-family starts remain almost 12% higher than last year,” Fratantoni said. “There are now almost 690,000 single-family homes under construction – the largest number since 2007. This is clearly a positive sign given the remarkably low levels of inventory on the market.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., noted concerns that higher new home prices may be causing some would-be buyers to pull back from the market. “Not to mention builders continue to face a shortage of skilled labor, materials and lots, all headwinds to increasing the pace of new home construction,” she said. “Some positives in the outlook for home building – the number of residential construction workers has increased in 11 out of the last 12 months and is above the pre-pandemic level, lumber prices are falling from record highs and the fundamentals driving new home sales are strong.”

Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C., said data from prior months were revised modestly higher, which makes the monthly decline in starts less worrisome.

“Home builders are still dealing with massive supply shortages and are having to manage the flow of their projects to a much greater degree than ever before,” Vitner said. “Even with these challenges, the industry is on a pace to begin construction on close to 1.6 million homes this year, which would be the best year for housing starts since 2006. Prospective buyer traffic has also slowed. One of the reasons buyer traffic is off is because builders have relatively few homes to show prospective buyers. Affordability is also a hurdle for many potential buyers, and the reopening of the economy, particularly the return to work and return to school, are competing for prospective buyers’ time right now.”

Despite the drop in starts, Vitner said home building remains “exceptionally” strong. “Overall housing starts have averaged a 1.577 million-unit pace over the past six months, which is very close to our estimate for the entire year. Such a pace would mark the strongest year for housing starts since 2006.”

Vitner also noted while the surge in home prices has kept attention focused on the single-family homes, the apartment market has regained considerable momentum. “Leasing picked up sharply during the first half of this year and rents have skyrocketed,” he said. “The bounce-back in apartment demand was swifter than expected and has cleared up some of the questions about whether young people would return to urban centers again—they have. Our sense is that once young people have a taste of their independence and the multitude of work and entertainment choices available in urban areas, they are unlikely to turn back. The real surprise has been the bounce-back in some of the hardest hit urban areas, including New York City and San Francisco.”

Apartments face their own affordability challenges, however. “While rents moderated somewhat in some higher-priced markets, they are rising rapidly in many of the Sunbelt markets, like Phoenix, Dallas and Atlanta, which are attracting lots of migrants from higher costs cities,” Vitner said. “There is a tremendous growth opportunity for more affordable apartment developments today, although delivering that product is more challenging amidst higher building material prices and higher labor costs. We recently boosted our forecast for multifamily starts for this year and next, based on the recent strong absorption numbers and rise in apartment rents.”

Mark Palim, Deputy Chief Economist with Fannie Mae, Washington, D.C., said while the softness in the starts pace is consistent with continuing reports from homebuilders describing supply chain disruptions and ongoing large construction backlogs, “the pace is finding a near-term bottom and will start to move upward in coming months.”

“Home Builders are progressing through their order books, freeing up capacity to increase the pace of starts going forward,” Palim said. “The most recent measure of new home sales showed a record share of homes being sold that were yet to be started. Combined with continued tight inventories of existing homes for sale and the recent decline in mortgage rates, we believe there to be continued strong demand for construction starts.”

The report said privately owned housing units authorized by building permits in July rose to a seasonally adjusted annual rate of 1,635,000, 2.6 percent higher than the revised June rate of 1,594,000 and 6 percent higher than a year ago (1,542,000). Single‐family authorizations in July fell to a rate of 1,048,000, 1.7 percent below the revised June figure of 1,066,000. Authorizations of units in buildings with five units or more rose to 532,000 in July, up by 11.1 percent from June and by 6.4 percent from a year ago.

“Permits for single-family homes dropped slightly over the month but were higher than a year ago and remain higher than the level of starts,” Fratantoni said. “The pace of construction should continue to increase, particularly if supply-chain constraints begin to loosen.”

“The bright spot in an otherwise underwhelming report comes from the increase in the overall number of permits issued, which can signal how much home construction is in the pipeline,” Kushi said. “The importance of more home building cannot be overstated. Inventory has been increasing in recent months, but we have underbuilt for a decade and July’s month-over-month decline in housing starts isn’t welcome news.”

Census said privately owned housing completions in July rose to a seasonally adjusted annual rate of 1,391,000, 5.6 percent higher than the revised June estimate of 1,317,000 and 3.8 percent higher than a year ago (1,340,000). Single‐family housing completions in July rose to 954,000, 3.6 percent higher than the revised June rate of 921,000. The July rate for units in buildings with five units or more rose to 426,000, up by 9.5 percent from June and by 12.1 percent from a year ago.