Mortgage Rates Dip Again

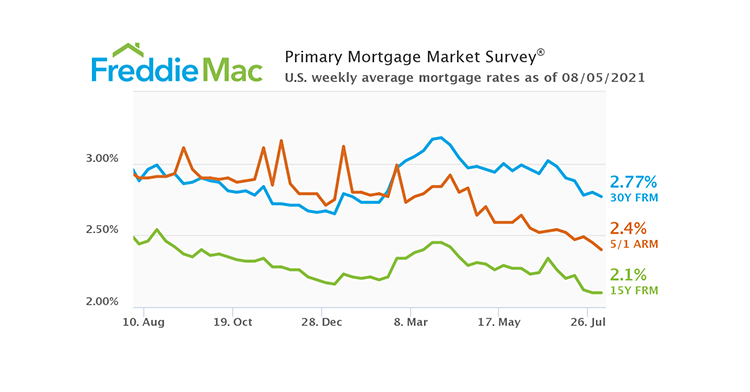

The 30-year fixed-rate mortgage dipped again last week to a 2.77 percent average with an average 0.6 point, reported Freddie Mac, McLean, Va.

This time last year the 30-year fixed-rate mortgage averaged 2.88 percent, the Freddie Mac Primary Mortgage Market Survey said. The government-sponsored enterprise released the report on Thursday, Aug. 5.

“With global market uncertainty surrounding the Delta variant of COVID-19, we saw 10-year Treasury yields drift lower and consequently mortgage rates followed suit,” said Sam Khater, Chief Economist at Freddie Mac.

Khater noted the 30-year fixed-rate mortgage has fallen back to where it stood at the beginning of 2021 and said the 15-year fixed remains at its historic low. “This bodes well for those still looking to refinance, renovate or even purchase a new home,” he said.

The report said 15-year fixed-rate mortgages averaged 2.10 percent with an average 0.6 point, unchanged from last week. A year ago at this time, the 15-year fixed-rate mortgage averaged 2.44 percent. The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.40 percent with an average 0.4 point, down from last week when it averaged 2.45 percent. One year ago the five-year ARM averaged 2.90 percent, Freddie Mac reported.

The Freddie Mac Primary Mortgage Market Survey focuses on conventional, conforming fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit. Borrowers may still pay closing costs, which are not included in the survey.