July Mortgage Credit Availability Increases Slightly

Mortgage credit availability increased slightly in July after a big drop in June, the Mortgage Bankers Association reported Thursday.

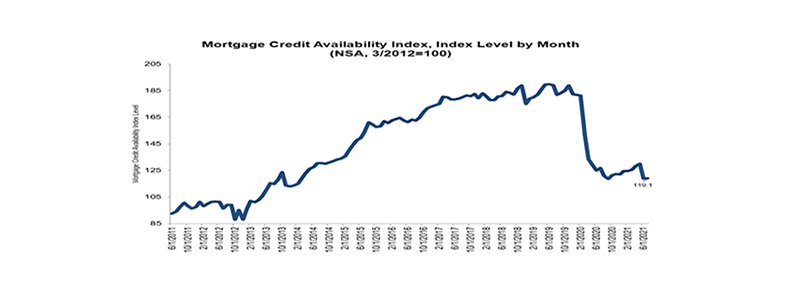

The MBA Mortgage Credit Availability Index, which analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool, rose by 0.3 percent to 119.1 in July. The Conventional MCAI increased 0.8 percent, while the Government MCAI was unchanged. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 3.8 percent and the Conforming MCAI fell by 3.2 percent.

A decline in the MCAI indicates lending standards are tightening, while increases in the index indicate loosening credit. The index benchmarks to 100 in March 2012.

“Credit availability slightly increased in July, driven by an increase in jumbo loan programs,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “The overall gain was despite another month of pullbacks in high-LTV refinance programs due to GSE policy changes.”

Kan said the elimination of more high-LTV refinance loans drove most of the 3 percent drop in the conforming index but said that was somewhat offset by lenders adding new refinance loan programs to help qualified, lower-income GSE borrowers. The bounce back in jumbo credit availability followed a sharp drop in June as some investors renewed their interest in jumbo ARM loans for cash-out refinances and investment homes, he said.

“Even as the economic recovery is underway, overall credit supply has remained close to its lowest levels since 2014,” Kan said. “Some borrowers are still in pandemic-related forbearance status, and servicers continue to work through possible resolutions for these borrowers.”

About the Mortgage Credit Availability Index

The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via the AllRegs Market Clarity product and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100;Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

MBA updated its methodology in August 2016, which produced an updated set of index values (historically and moving forward), for more information on this updated methodology visit www.mba.org/MortgageCredit and read the FAQ and Methodology documents. Any historical data obtained prior to August 2016 is not comparable to the current, revised index and should be replaced with the new history.

Click here to learn more about the AllRegs Market Clarity platform.

For more information on the Mortgage Credit Availability Index, including methodology, frequently asked questions and other helpful resources, click here or contact MBAResearch@mba.org.