MBA: 2020 IMB Production Volumes, Profits Hit Record-Highs

Independent mortgage banks and mortgage subsidiaries of chartered banks made an average profit of $4,202 on each loan they originated in 2020, up from $1,470 per loan in 2019, the Mortgage Bankers Association reported last week.

The MBA Annual Mortgage Bankers Performance Report also estimated 2020 production volume at $3.83 trillion – the highest annual volume ever reported – up from $2.25 trillion in 2019.

“2020 was a banner year for the mortgage industry, despite the COVID-19 global health crisis essentially shutting down the U.S. economy in March and forcing personnel into remote work environments,” said Marina Walsh, CMB, MBA Vice President of Industry Analysis. “A surge in housing and mortgage demand, record-low mortgage rates and widening credit spreads translated into soaring net production profits that reached their highest levels since the inception of MBA’s annual report in 2008.”

Walsh noted in an unusual twist, the driver of production profitability in 2020 was production revenue, led by strong secondary marketing gains. She said historically, production expenses drop when volume increases, but per-loan production expenses rose in 2020, as companies offered signing bonuses, incentives, overtime and other compensation to address capacity constraints and meet mortgage demand. Furthermore, rising loan balances meant hefty sales commissions, often earned based on a percentage of the loan amount.

“On the servicing side of the business, heavy prepayments, combined with elevated default and forbearance activity, contributed to a loss of servicing income,” Walsh said. “Valuation markdowns on mortgage servicing rights and servicing amortization resulted in heavy hits to the overall servicing bottom line, especially for those servicers that did not hedge their MSRs.”

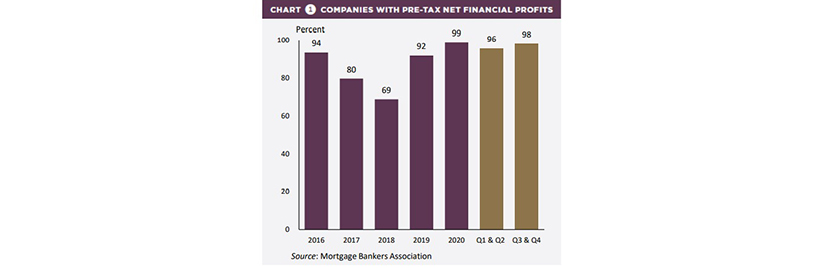

The report said profits on the production side of the business generally compensated for the servicing losses. Including both production and servicing operations, 99 percent of the firms posted overall pre-tax net financial profits in 2020, compared to 92 percent of firm in 2019 and only 69 percent of firms in 2018.

“In early 2021, we are already seeing declines in pipeline volume – particularly refinance volume – as mortgage rates have risen in the first quarter,” Walsh said. “Also, secondary marketing income has dropped from last year’s highs, as credit spreads have tightened. Mortgage companies that can adjust quickly to changing market conditions and are able to harness still robust purchase demand are best poised for a successful 2021.”

Other key findings of the MBA 2020 Annual Mortgage Bankers Performance Report:

- Average production volume rose to$4.5 billion (16,198 loans) per company in 2020, up from $2.7 billion (10,411 loans) per company in 2019. On a repeater company basis, average production volume rose to $4.4 billion (15,669 loans) in 2020, up from $2.5 billion (9,430 loans) in 2019. For the mortgage industry as whole, MBA estimates production volume at $3.83 trillion in 2020 – the highest annual volume ever reported – up from $2.25 trillion in 2019.

- In basis points, average production profit (net production income) grew to 157 basis points in 2020, compared to 58 basis points in 2019. In the first half of 2020, net production income averaged 131 basis points, then rose to 174 basis points in the second half of 2020. Since inception of the Annual Performance Report in 2008, net production income by year has averaged 58 bps ($1,299 per loan).

- The refinancing share of total originations (by dollar volume) increased to 55 percent in 2020 from 34 percent in 2019. For the mortgage industry as a whole, MBA estimates refinancing share last year increased to 63 percent from 46 percent in 2019.

- Average loan balance for first mortgages reached a study-high of $278,725 in 2020, up from $266,533 in 2019. This is the 11th consecutive year of rising loan balances on first mortgages.

- Total production revenues (fee income, net secondary marking income and warehouse spread) rose to 434 basis points in 2020, up from 356 bps in 2019. On a per-loan basis, production revenues rose to $11,780 per loan in 2020, up from $9,004 per loan in 2019.

- Total loan production expenses – commissions, compensation, occupancy, equipment and other production expenses and corporate allocations – increased to $7,578 per loan in 2020, up from $7,535 in 2019.

- Personnel expenses averaged $5,272 per loan in 2020, up from $5,094 per loan in 2019.

- Productivity averaged 3.3 loans originated per production employee per month in 2020, up from 2.3 in 2019. Production employees include sales, fulfillment and production support functions.

- Net servicing financial income, which includes net servicing operational income, as well as mortgage servicing rights (MSR) amortization and gains and losses on MSR valuations, fell to $(176) per loan in 2020, down from $(116) per loan in 2019.

- Including all business lines, 99 percent of the firms in the study posted pre-tax net financial profits in 2020, up from 92 percent in 2019. In the first half of 2020, 96 percent of reporting repeater firms posted pre-tax financial profits, compared to 98 percent in the second half of 2020.

The MBA Mortgage Bankers Performance Report series offers a variety of performance measures on the mortgage banking industry and is intended as a financial and operational benchmark for independent mortgage companies, subsidiaries and other non-depository institutions. Of the 261 firms that reported production, 84 percent represented independent mortgage companies; the remaining 16 percent represented subsidiaries and other non-depository institutions.

MBA produces five performance report publications per year: four quarterly reports and one annual report. To purchase or subscribe to the publications, visit mba.org/performancereport.