Millennials, Gen Z More Than Twice as Likely to Delay Financial Milestone Due to COVID-19

Although an increasing number of U.S. adults have been vaccinated and look forward to resuming pre-pandemic activities, a new Bankrate.com survey indicates that nearly two in five (39%) individuals have delayed a financial milestone because of the pandemic.

Most negatively affected have been millennials (ages 25-40) and members of Generation Z (ages 18-24), where more than half (58% of millennials and 54% of Gen Z, respectively) say they’ve delayed a major milestone.

When asked which milestones were delayed specifically because of the COVID-19 pandemic, the following answers were given, along with the group most affected:

• Thirteen percent buying or leasing a car, cited by 19% of older millennials (ages 32-40)

• Twelve percent buying a home, cited by 21% of millennials

• Eleven percent pursuing career advancement, cited by 21% of Gen Z

• Ten percent furthering education, cited by 21% of Gen Z

• Six percent having children, cited by 15% of younger millennials (ages 25-31)

• Six percent getting married, cited by 14% of younger millennials

• Five percent retiring, with no single group dominating (4%-5% across all cohorts)

Generation Z and millennials are more than twice as likely as their elders (ages 41+) to have delayed a major milestone (57% of those ages 18-40 vs. 26% elders) including career advancement (19% of those ages 18-40 vs. 6% elders) and purchasing a home (18% of those ages 18-40 vs. 8% elders).

“Most, if not all, of us have had to delay or sacrifice some financial activity, spending or milestone during the pandemic,” said Bankrate.com senior economic analyst Mark Hamrick. “How quickly we rebound depends on some combination of how or whether we were prepared for the unexpected downturn when it began, how we managed during it and how quickly we get back to a resumption of activities previously taken for granted.”

Hamrick noted, however, many Americans have managed to save more money during this time, “and in the process learning that, if necessary, some things we can do without.”

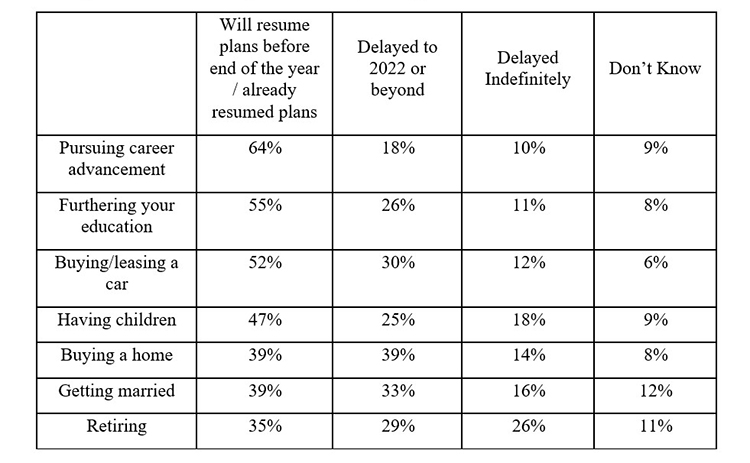

Among those who cited delayed milestones, the length of time sacrificed varied:

“Trillions of dollars in federal spending will help to spur a more robust economic recovery in the months ahead,” Hamrick said. “Whether emboldened by savings or stimulus dollars, or both, many individuals might be eager to let spending rip as the economy reopens. But a balanced approach is called for, including the need for save for emergencies. Whether it is an interruption in income, a natural disaster, or even a pandemic, the best insurance policy for personal finances is sufficient, or more, emergency savings.”