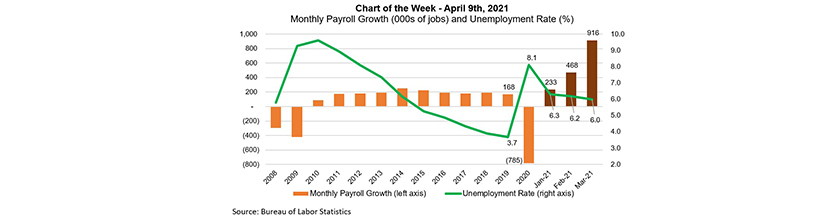

MBA Chart of the Week Apr. 12 2021: Monthly Payroll Growth/Unemployment Rate

This week’s chart summarizes the recent strength of the job market. According to the Bureau of Labor Statistics, job growth accelerated sharply in March, as the economy gained 916,000 jobs over the month, the largest monthly gain since August 2020. The gains were across several sectors, including both goods-producing (+183,000 jobs) and service-providing industries (+597,000 jobs).

As COVID-19 vaccinations continue to be administered, service sector jobs, which have been impacted the most by social distancing and the reduction of in-person activity, continue to be added to the economy. For example, two of the hardest hit sectors, education and leisure and hospitality, saw a second straight month of robust gains. While some sectors have suffered, others have gained. The pandemic increased the use of delivery services, which can be seen in employment levels for couriers and messengers, as well as warehousing and storage. Both categories are currently above pre-pandemic levels and continuing to show growth.

From a housing market perspective, the 110,000 job gain in construction was a welcome sign, as there is a desperate lack of inventory in the housing market that is driving up home prices at an unsustainable pace. Because of the improving job market and economic growth this year, housing demand will remain quite strong, even if mortgage rates increase above 3.5 percent.

We expect that overall job gains will continue as businesses gear up to meet consumer demand after months of suppressed spending and increased savings. This will also drive improvement in the unemployment rate, which is expected to fall below 5 percent by the end of the year. However, there are still more than 4.2 million people who have been unemployed for more than 6 months, and total employment remains 5.5 percent below the February 2020 peak. The stimulus payments and renter and homeowner relief that were part of the American Rescue Plan will provide support for struggling individuals who are unemployed or underemployed, including the 2.5 million homeowners currently in forbearance plans.

–Mike Fratantoni mfratantoni@mba.org; Joel Kan jkan@mba.org.