Mark P. Dangelo: Innovation Disruption Does NOT = BAU

Mark P. Dangelo is Chief Innovation Consultant with BlackFin Group, Laguna Hills, Calif., responsible for leading and managing innovation-led business transformation and technology projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of four innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

Written just before the start of this decade, Beyond the Technology Traps was a strategy book for financial services and banking organization on how digital transformations would permanently remake companies. In it, the author focused on the future of customer and market impacts on FSBO operations and profitability. The conclusions were clear—FSBOs and their highly skilled staff have a material blind spot in an age of digital consumer ecosystems. They do not comprehend or accept the hidden, complex, and changing supply chains that ebb and flow across their specialized, siloed offerings.

Today against the details defined across the book’s chapters, these playbook changes are taking place driving home the reality that the functions performed by banking and lending organizations can be replaced as data, technologies, and consumer behaviors alter the delivery rationale, which were built by decades of internal organizational culture of “We define how consumers use our services.” That equation of certainty is now replaced with consumers telling lenders and FSBOs what they value and how they expect to engage with them now and into the future.

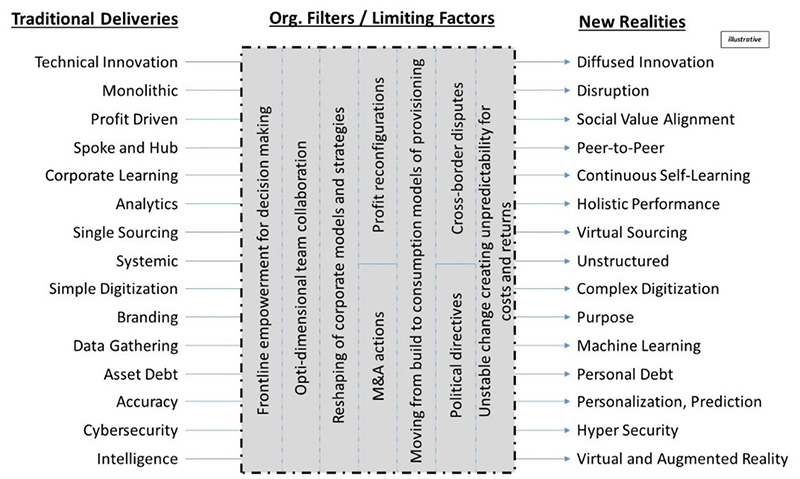

As shown in the illustrative figure below, next gen is now being filtered by traditional organizational constraints and limiting factors when it comes how future innovation disruption will be processed. The consumer and non-traditional competitors are moving beyond the technology traps that were cornerstones of the Industry 3.0 often referred to as the internet era solutions. The “now” reality is that leaders are facing a landscape where the traditional playbook of how to deal with innovation is broken and obscured with the success of the current volume cycle. Why change if you’re making money?

It is All About Accepting and Understanding Supply Chains—Competitors Will

The reason why market disruption continues to gain efficacy is that entrenched companies working within an industry ripe for disruption never see it coming. Even when they have every reason to believe that it will occur, they do not believe it until it is too late. In complicated industries subject to strict government oversight (e.g., financial services), this problem is exacerbated because incumbents feel that the barriers to entry are simply too high for anyone without as much experience as they possess.

Disintermediation of functions and supply chains translates into taking out traditional processes, taking out traditional methods of doing business, and going directly to the consumer. The most visible historical example can be witnessed in the equity’s world—straight through processing and how consumers leverage continues to shake the foundations of traders and the markets (e.g., Robinhood).

That is what disintermediation is all about starting from the customer to the real estate to loans to secondary markets to the regulators that oversee all information exchanges and adherence to the “spirit” of legislation. Essentially, we are attempting to comprehend all (big) data and dialogues from the consumers all the way to the servicers and investors who administer to and profit from the relationship. A common representation of the loan cycle uses 56 functional compartments from the customer into the secondary markets. The illustration below touches on a few of those discrete realities embedded within each of the silos of operation.

Today, innovations and data have touched 47 of them and likely will comprehensively remake the remainder within the next 24 months. How long will it be before the functions are collapsed as data and loan STP remake the value proposition and business model of warehouse lines, brokers, full-service operations and even the customer expectations? What non-traditional competitor will recognize the inherent “supply chain waste” and seek to move the effort from months or weeks down to days?

Digital Transformations are Driven by Disintermediation Demands

My colleagues sometimes refer to digital transformation and the disintermediation it is addressing as a “death by a thousand cuts.” For no matter how eager visionary leaders are to remake the supply chains (driven by disintermediation) to address customer demands, their expectations never seem to match the reality of the ensuing chaos that often envelops the events.

The biggest, most immediate risk will be that FSBO’s are cut out of the relationships they currently enjoy with customers. What will happen when they are not controlling that relationship anymore? What happens if financial data and/or customer contacts reside with partners or competitors rather than within the internal infrastructures FSBOs have built over the decades? Are we just left with the “financial plumbing” or some sort of a utility model across the FSBO supply chains (i.e., BaaS)? Does your organization recognize that today they do not control the primary channels to consumers (e.g., omnichannels), and that over 60% of financial transactions and the linked information is outside of the FSBO firewalls?

If FSBOs become nothing more than a commodity or behind-the-scenes fulfiller within their markets, their business models will lead them to comprehensive ruin. As the ability to disintermediate existing products, services, and fulfillment moves along the FSBO supply chains and impacts the relationships between partners, once valued products and services will be retired due to lack of applicability as FSBOs recognize that they no longer can influence that channel or product suite. The channel is no longer going to be driven by the institution’s historical relationships with the consumers. Whoever is providing the delivery platform or mechanism will now control product and service consumption advances, directions, and offerings.

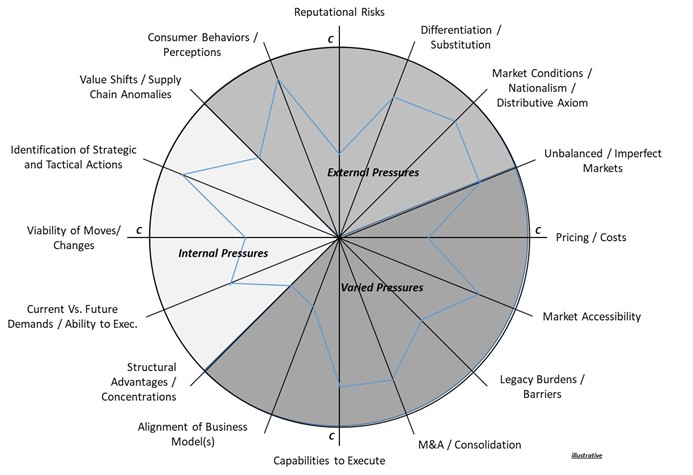

If we broke a FSBO up along 12 distinct but generic continuums, we would not only gain insight into markets being served and likely profitability, but adaptability, and even capabilities. A representative set might include:

- Layers of needs

- Layers of solutions

- Layers of regulation

- Consumer shifts

- Data and digitization

- FinTech

- Market sentiments

- Economic uncertainties

- Privacy, security, and recoverability

- Analytics and measurements

- Availability of skills

- Legacy, legacy, legacy

Moreover, by further decomposing an organization along lines of business (e.g., mortgage, asset management, brokerage, and security), another layer of insight would be gleaned from the black boxes containing the institution’s inner workings. Now add another layer of experts, advisors, and political pundits and you have a delivery mix that quickly becomes opaque and prone to long-lead times to “get it right.” All these distinctions when combined add multiple layers of complexity into existing supply chains. The remaking of new chains using innovative building blocks assembled in layers of features change can we change as fast as the consumers and markets without the baggage of the past. Bu FSBO’s have not arrived at the same practices and principles that best-in-class firms like Amazon, Apple, Alibaba and even Walmart have embraced.

The Delivery Rules are Changing Using a Time of Profitability

For FSBOs spurred by rapid digitization and smart mobile innovations, the time for mass disruption is arriving quicker than projected. Profitability is hiding what is definitely coming.

In the end, FSBO disintermediation is not a game of checkers—it represents a game of chess. What FSBOs need to accept today is that they are competing in a marketplace made up of an ever-changing mosaic of options, solutions, customer demands, and partner capabilities—all tempered by regulators and fickle politicians. The non-traditional competitors do not have the cultural biases or sunk asset risks of disrupting markets to meet consumer and investor expectations.

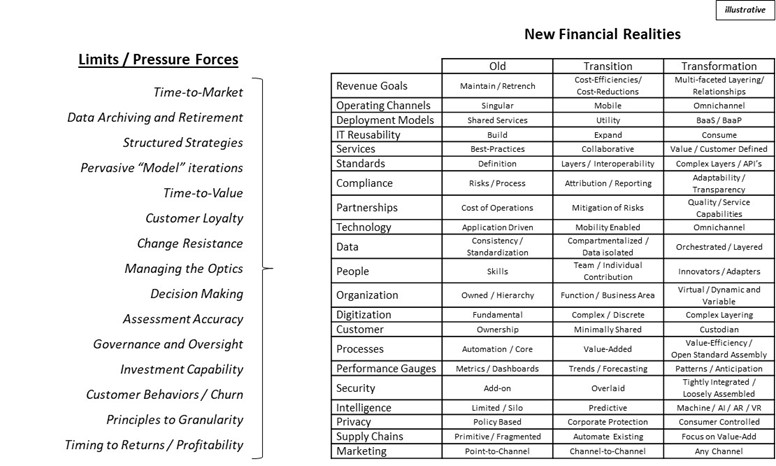

Consumers expect FSBOs to be more flexible in how they deliver, more strategic in how they deploy technologies to meet emerging customer needs, and more capable of anticipating those needs. That is chess—thinking several moves ahead as the match continues. Too many FSBOs are still playing checkers, making the same moves, and expecting consumers and competitors to play by the same rules. It should come as no surprise that they are losing the game. The illustration below touches on a few of the shifts happening and the typical coverage being addressed across leadership teams dealing with unfamiliar digital transformations brought on by disintermediation.

The value proposition within digital economies is still compelling for FSBOs, but these economic trends are shifting because of behaviors and innovations outside the organization’s control. Additionally, the capability of existing digital transformation teams is insufficient to create sustainable and repeatable digital solution sets in an era where innovational advancements are measured in weeks and months. Digital demands must be not only designed and implemented, but also developed literately and using compartmentalized features.

When it comes to innovation disruption efforts, there is a failure to recognize that frameworks are more powerful than prescriptions, that iterations and pivoting are more important than strategic plans, that digital demands are not lift-and-shifts, but layers, building blocks and data governance built on the new business foundations of data oceans. In the end, delivery of innovation disintermediation is not simply using tradition—it is something else entirely.

FSBOs are used to building or buying an application solution, holding it for 5, 10, 15 or 20 years. As we know, that does not work today or tomorrow—and likely has been an anchor against change for years.

In the End …

If disintermediation cues are missed, careers are destroyed, and customer and investor values are lost. Was it the financial engineering that was wrong? Did the innovation efforts fail in their goal for a “deep dive and strong customer loyalty?” Did the leadership teams apply proven methods to new digital realities only to discover they lacked relevancy across disintermediated supply lines?

As financial leaders, you cannot continue to execute along paths during the rise of Industry 4.0 using the familiar remedies devised during Industry 3.0. The need to prepare to the future “Unknown Unknowns” as supply chains are rendered fluid and the functions once demanded are becoming irrelevant, cannot be discounted just because money is being made today.

For leaders who fail to embrace the holistic and continually disintermediation trends, they cannot “lay low” waiting for events to take away the transformation demands. In the end, “Launchpad Chicken” is not a sustainable career path for future leaders.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)