Initial Claims Rise; Trend Stays Positive

Initial claims for unemployment insurance rose by more than 60,000 last week—a setback after the previous week’s sharp drop. But the Labor Department said the positive downward trend is likely to continue.

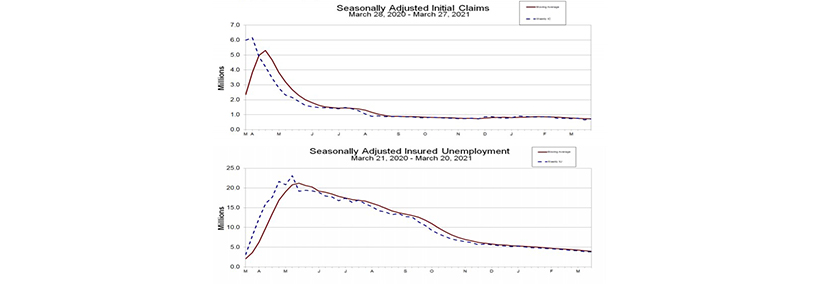

The report said for the week ending March 27, the advance figure for seasonally adjusted initial claims rose to 719,000, an increase of 61,000 from the previous week’s level, which revised down by 26,000 from 684,000 to 658,000. The four-week moving average fell to 719,000, a decrease of 10,500 from the previous week’s revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500.

The advance seasonally adjusted insured unemployment rate was unchanged at 2.7 percent for the week ending March 20 from the previous week. The advance number for seasonally adjusted insured unemployment during the week ending March 20 fell to 3,794,000, a decrease of 46,000 from the previous week’s level, which revised down by 30,000 from 3,870,000 to 3,840,000. The four-week moving average fell to 3,978,500, a decrease of 147,250 from the previous week’s revised average.

The report said the advance number of actual initial claims under state programs, unadjusted, totaled 714,433 in the week ending March 27, an increase of 63,282 (or 9.7 percent) from the previous week. Seasonal factors had expected an increase of 2,177 (or 0.3 percent) from the previous week. Labor reported 5,981,787 initial claims in the comparable week in 2020. In addition, for the week ending March 27, 52 states reported 237,025 initial claims for Pandemic Unemployment Assistance.

The advance unadjusted insured unemployment rate fell to 2.9 percent during the week ending March 20, a decrease of 0.1 percentage point from the prior week. The advance unadjusted level of insured unemployment in state programs totaled 4,142,940, a decrease of 90,696 (or -2.1 percent) from the preceding week. Seasonal factors had expected a decrease of 43,813 (or -1.0 percent) from the previous week. A year earlier the rate was 2.3 percent and the volume was 3,412,516.

The total number of continued weeks claimed for benefits in all programs for the week ending March 13 was 18,213,575, a decrease of 1,517,926 from the previous week. Labor reported 2,102,852 weekly claims filed for benefits in all programs in the comparable week in 2020.

“Initial filings for jobless claims rose last week, but the downward trend remains intact,” said Sarah House, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “Revisions show last week’s filings dipped below their Great Recession peak, but the level of claims remains distorted. Overall, the lower trend in filings in recent weeks points to a substantial pickup in hiring in [Friday’s] payroll report.”

House noted since March 2020, 79 million claims for regular benefits have been filed, with another 28 million filed under the new Pandemic Unemployment Assistance program. “Together, that equates to 70% of payrolls (or 67% of household employment) pre-pandemic and reflects duplicate filings and fraud, but also the tremendous churn in the labor market since COVID, with some workers losing jobs more than once as restrictions and activity fluctuated this past year,” she said.

House said the continued downward trend points to a hiring pickup. “We look for [Friday’s] payroll report to show that hiring is shifting into a higher gear,” she said. “We look for a substantial rebound in hiring over the next few months, with March payrolls being a big step along the way.”

The Bureau of Labor Statistics releases its March Employment report at 8:30 a.m. ET. Mortgage Bankers Association Chief Economist Mike Fratantoni will provide analysis in the Monday, Apr. 5 edition of MBA NewsLink.