Regrets? For Some Homeowners During Pandemic, a Few

A new survey from LendEDU, Hoboken, N.J., finds more than half of new homeowners regret taking out a mortgage during the coronavirus pandemic, with most of them citing a job layoff as the reason for their angst.

The LendEDU survey of 1,000 homeowners with a mortgage also found that many homeowners have taken advantage of current mortgage rates by refinancing during the pandemic, while pandemic forbearance agreements are leading to incorrect negative credit marks.

“It’s especially interesting to think that many consumers might be jumping the gun on a mortgage due to low rates only to end up struggling to make mortgage payments each month due to the poor economy,” said Mike Brown, Director of Communications with LendEDU and the report’s author.

Key findings of the report (https://lendedu.com/blog/mortgages-during-coronavirus-report/):

–Among Americans who became homeowners during the pandemic, 54% wanted to take advantage of the currently low mortgage rates, while 15% wanted to move out of a location hit hard by the coronavirus pandemic, such as New York City.

–Among new homeowners, 55% now regret becoming a homeowner during the pandemic, with 30% citing subsequent financial struggles.

–54% of all homeowners (took out a mortgage either before or during the pandemic) who have agreed pandemic forbearance or a reduced monthly minimum payment have seen incorrect negative marks on their credit report.

–26% of all homeowners have refinanced their mortgage during the pandemic, with 90% receiving a lower interest rate than before.

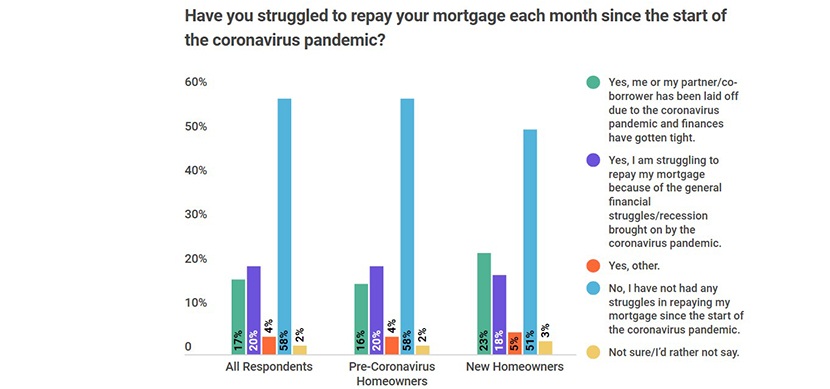

–17% of all homeowners have struggled to pay their mortgage due to getting laid off, while 20% have struggled due to general financial difficulties during the pandemic recession.

–Only 58% of all homeowners indicated they have not struggled to make mortgage payments during the pandemic.

–16% of all homeowners have agreed to pandemic forbearance with their mortgage lender, while 11% have agreed to a reduced monthly minimum payment. Those percentages are 18% and 25% for only new homeowners.

The coronavirus pandemic has shut down countless small businesses, laid off millions of Americans, and tanked the economy into a recession,” the report said. “Strangely enough, however, this unprecedented moment in history can also be characterized by a red-hot real estate market. With mortgage interest rates at all-time lows throughout the pandemic, homebuyers have come out in droves.”

The report, which sources data from the Mortgage Bankers Association, noted mortgage lenders have demonstrated flexibility and an understanding of the current financial circumstances by agreeing to temporary forbearance periods or reduced monthly payment requirements. “It appears this is especially true for those who took out a mortgage during the pandemic, as our survey found 18% have been granted pandemic forbearance, while 25% have agreed to a reduced monthly minimum mortgage payment,” it said.