Unemployment Claims Fall Back Under 1 Million—With an Asterisk

Initial claims for unemployment fell under one million last week for just the second time since March, but the change largely reflected a change in methodology by the Labor Department and remain elevated by historical standards.

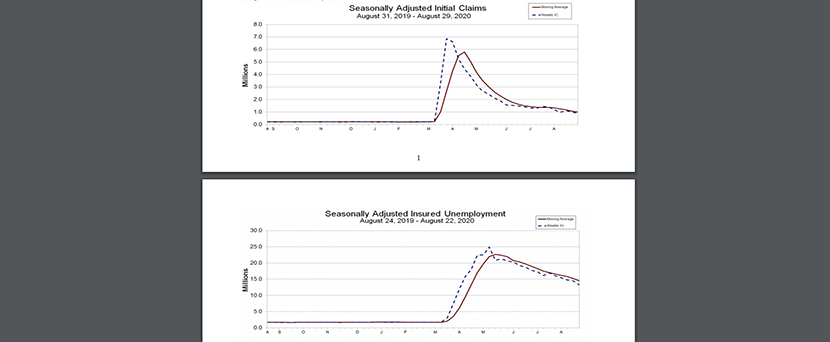

For the week ending August 29, Labor reported the advance figure for seasonally adjusted initial claims fell to 881,000, a decrease of 130,000 from the previous week’s revised level. The four-week moving average fell to 991,750, a decrease of 77,500 from the previous week’s revised average.

The advance seasonally adjusted insured unemployment rate fell to 9.1 percent for the week ending August 22, a decrease of 0.8 percentage point from the previous week’s unrevised rate.

The advance number for seasonally adjusted insured unemployment—also known as continuing claims—for the week ending August 22 was 13,254,000, a decrease of 1,238,000 from the previous week’s revised level. The four-week moving average fell to 14,496,250, a decrease of 709,000 from the previous week’s revised average.

Labor issued a clarification yesterday noting a change in methodology that reflects “additive factors” rather than “multiplicative factors.” Labor said multiplicative factors can result in “systematic over- or under-adjustment.”

“In times of relative economic stability, the multiplicative option is generally preferred over the additive option,” Labor said. “However, in the presence of a large level shift in a time series, multiplicative seasonal adjustment factors can result in systematic over- or under-adjustment of the series; in such cases, additive seasonal adjustment factors are preferred since they tend to more accurately track seasonal fluctuations in the series and have smaller revisions.

Sarah House, Senior Economist with Wells Fargo Securities, warned the marked drop in initial claims was overstated by the change in methodology, and should not be interpreted a sign the labor market’s recovery is kicking into higher gear.

“The trend in claims remains lower, but only gradually,” House said. “Since the Department of Labor did not apply the new methodology to prior data yet, the drop in today’s headline number embellishes the rate of improvement and should not be viewed as a sign that the labor market’s recovery is kicking into a higher gear.”

House said other aspects of the report signaled that the labor market “continues to struggle, with improvement painfully slow and occurring in fits and starts.” However, she noted the modest downward trend in claims the past few weeks “is one sign that the labor market’s recovery has at least not gone into reverse and that employers continued to add jobs in August.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C, noted Labor apparently will not re-adjust previously published data with the new methodology, thus, this week’s figures are not directly comparable to prior weeks.

“Regardless of the change in statistical methodology, initial claims remain historically elevated; despite falling to a fraction of the peak value set in late March, initial claims are still above the highest level seen during the previous recession,” Duncan said.

The Bureau of Labor Statistics will release its August Employment Report this morning at 8:30 a.m. ET, last month, BLS reported the unemployment rate at 10.2 percent.