Pandemic Stokes Robust Demand For Life Sciences Real Estate

CBRE, Los Angeles, said the COVID-19 pandemic has accelerated the U.S. life sciences industry’s momentum, particularly amid the race to produce a vaccine and other medicines.

“The sector has reached new highs this year in R&D employment and venture-capital funding and is seeing a surge in demand for life sciences real estate in markets from longstanding centers life sciences such as Boston and San Francisco to emerging hubs including Pittsburgh,” CBRE reported.

The life sciences industry, which accelerated when the human genome was mapped in 2003, has pushed vacancy rates for lab space to near-record lows in many markets, fueled rent growth and spurred new development that struggles to keep pace with demand.

“Interest in the life sciences sector from developers, investors and financial backers already was strong in recent years, and the unfortunate arrival of COVID-19 brought even more attention and capital into the sector,” said Steve Purpura, who leads CBRE’s Life Sciences Practice in the northeast U.S. “That has boosted the market for lab space across the U.S., not only in the industry’s flagship markets like San Francisco, Boston and San Diego but also in emerging research centers such as New York City, Philadelphia, Raleigh-Durham and Seattle.”

CBRE found speculative construction of life sciences facilities in the 13 largest U.S. markets totaled nearly 14 million square feet as of July, well short of the 14.7 million square feet of life sciences space that companies currently are currently seeking in those markets. Lab-space vacancy averaged 6.1 percent across the 13 largest life sciences markets at the end of the second quarter and rents are rising in most.

The real estate gains come as venture-capital investment in the sector grew to a rolling annual total of $17.8 billion in the second quarter, the largest amount on record, PwC and CB Insights reported in their MoneyTree survey.

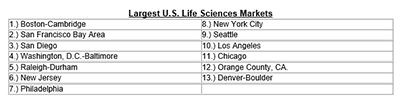

CBRE identified the top U.S. life sciences markets by assessing each market’s life-sciences job base, the size of its lab-space inventory and the funding it attracts from venture capital firms and the National Institutes of Health. It calculated the largest U.S. life sciences markets include Boston-Cambridge, Mass., San Francisco and San Diego.

“Nearly every indicator points to increasing demand for life sciences real estate in the U.S., be it expanding R&D employment, public and private investment in combating the pandemic or the health needs of our aging population,” said CBRE Americas Head of Office Research Ian Anderson. “The factors fueling this sector are great enough to support demand for more lab space in the top markets and beyond.”