Home Prices Continue to Show Strength

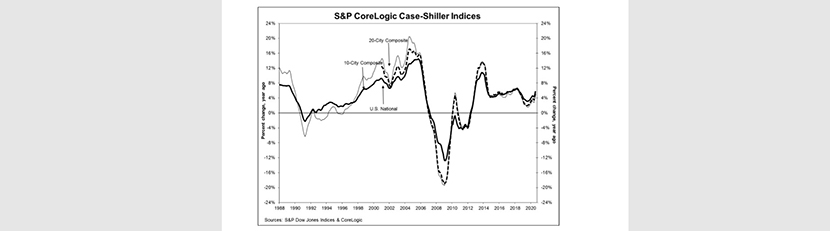

S&P Dow Jones Indices, New York said its S&P CoreLogic Case-Shiller Indices showed home prices continue to increase at a modest rate across the U.S., rising by 5.7 percent annually in August.

Year over year, the National Home Price NSA Index reported a 5.7% annual gain in August, up from 4.8% in July. The 10-City Composite annual increase came in at 4.7%, up from 3.5% in July. The 20-City Composite posted a 5.2% year-over-year gain, up from 4.1% the previous month.

Phoenix led with a 9.9% year-over-year price increase, followed by Seattle at 8.5% and San Diego at 7.6%. All 19 cities reported higher price increases in the year ending August versus the year ending July (complete data for the 20th city, Detroit, were not available).

Month over month the National Index posted a 1.1% increase, while the 10-City and 20-City Composites both posted increases of 1.1% before seasonal adjustment in August. After seasonal adjustment, the National Index posted a month-over-month increase of 1.0%, while the 10-City and 20City Composites both posted increases of 0.5%. In August, all 19 cities (excluding Detroit) reported increases before seasonal adjustment, while 17 of the 19 cities reported increases after seasonal adjustment.

“Housing prices were strong in August,” said Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy with S&P Dow Jones Indices. “A trend of accelerating increases in the National Composite Index began in August 2019 but was interrupted in May and June, as COVID-related restrictions produced modestly-decelerating price gains. We speculated last month that the accelerating trend might have resumed, and August’s results easily bear that interpretation. The last time that the National Composite matched August’s 5.7% growth rate was 25 months ago, in July 2018. If future reports continue in this vein, we may soon be able to conclude that the COVID-related deceleration is behind us.”

The report said as of August, average home prices for the MSAs within the 10-City and 20-City Composites are exceeding to their winter 2007 levels. The index is now 21% above the last peak, reached during pre-Great Recession

Wanted to circle back here to share some additional commentary from CoreLogic Deputy Chief Economist Selma Hepp on the S&P CoreLogic Case-Shiller National Home Price Index for August that went live this morning:

“The forgone spring home-buying season appears to have fully shifted into summer months, leading to sales volumes that are picking up speed at a time when they would normally show signs of slowing,” said Selma Hepp, Deputy Chief Economist with CoreLogic, Irvine, Calif. “Not only was demand fueled by buyers planning on purchasing a home in the spring, but also by those motivated by record-low mortgage rates, desire for a larger home or desire for a vacation home as a result of the pandemic.”