MBA Chart of the Week: Appetite for Commercial/Multifamily

One of the most striking aspects of the pandemic’s impact on commercial real estate markets is the markedly disparate impact it is having on different property types. Looking at rent collections, mortgage originations or loan performance, retail and hotel properties – the property types most immediately and dramatically affected by the virus and our reactions to it – jump out on the negative side, while industrial and multifamily tend to stand out more positively.

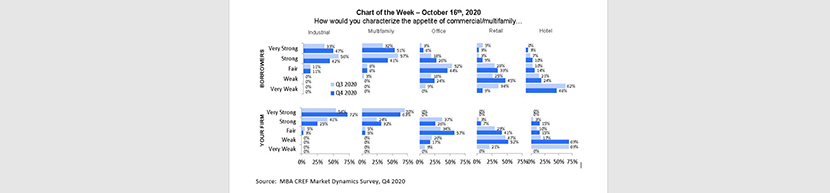

A new MBA survey of leading commercial real estate finance firms shows how this is playing out in the mortgage market. The survey looks at the appetites of borrowers to take out – and originators to make – new loans.

CRE mortgage demand is generally on the rise, with four times more firms expecting borrower demand to be “very strong” in the fourth quarter (24%), compared to the 6% who believed demand was “very strong” in the third quarter. Opinions were mixed, with one-in-four reporting borrower demand in the fourth quarter will be “very strong,” and more than a third, respectively, expecting “strong” and “fair” appetites from borrowers. Relatively equal – and large – numbers of CRE finance firms reported “strong” and “very strong” appetites at their firms to make loans in the fourth quarter (89%) as they saw in the third quarter (83%).

But the market is highly segmented by property type – with more firms reporting strong appetites from both borrowers and their own firms for industrial and multifamily property loans, than appetites for office, retail or hotel properties. Differences also cross capital sources, with stronger appetites to lend coming from Fannie Mae, Freddie Mac and FHA loan products, followed by life insurance companies, investor-driven lenders, CMBS and banks. It is important to note that even within property types and capital sources, there was a wide range of views expressed by firms.

Across fundamentals, capital markets and loan performance, CRE markets continue to adjust to changing conditions, with separate parts of the market behaving very differently.

—Jamie Woodwell jwoodwell@mba.org; Reggie Booker rbooker@mba.org.