Economy Shows Hint of Recovery

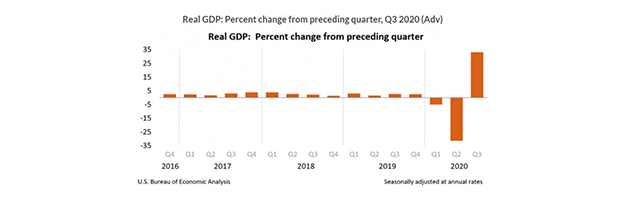

What goes down must come up: after the coronavirus resulted in a staggering record drop in the second quarter, the U.S. economy bounced back somewhat in the third quarter, according to the first (advance) estimate of gross domestic product.

The Bureau of Economic Analysis yesterday reported real gross domestic product increased at an annual rate of 33.1 percent in the third quarter. The remarkable rebound came on the heels of a record-high plunge in GDP (31.4 percent) in the second quarter and signaled a partial recovery of the U.S. economy, although output remains well below pre-pandemic levels.

BEA said the GDP estimate is based on source data that are incomplete or subject to further revision by the source agency. The second (revised) estimate for the third quarter, based on more complete data, will be released on November 25; the third (final) estimate will be released in December.

The report said the increase in real GDP reflected increases in personal consumption expenditures, private inventory investment, exports, nonresidential fixed investment, and residential fixed investment that were partly offset by decreases in federal government spending (reflecting fewer fees paid to administer the Paycheck Protection Program loans) and state and local government spending. Imports, a subtraction in the calculation of GDP, increased.

The increase in PCE reflected increases in services (led by health care as well as food services and accommodations) and goods (led by motor vehicles and parts as well as clothing and footwear). The increase in private inventory investment primarily reflected an increase in retail trade (led by motor vehicle dealers). The increase in exports primarily reflected an increase in goods (led by automotive vehicles, engines, and parts as well as capital goods). The increase in nonresidential fixed investment primarily reflected an increase in equipment (led by transportation equipment). The increase in residential fixed investment primarily reflected an increase in brokers’ commissions and other ownership transfer costs.

“Economic growth rebounded strongly in the third quarter, with multiple segments of the economy – after a sharp plunge in the second quarter – showing strong growth,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “Expressed as an annual rate, consumer spending on durable goods was up more than 80%, business spending on equipment increased more than 70%, residential investment increased almost 60%, and both exports and imports of goods were up over 100%. The data show a picture of an economy re-opening and restocking over the summer.”

Fratantoni said third quarter growth is consistent with gains seen in the job market. “MBA expects that the pace of economic growth will slow in the fourth quarter and into next year, but expansion should nonetheless continue, provided the current spike in virus cases does not lead to another complete lockdown,” he said.

Jay Bryson, Chief Economist with Wells Fargo Securities, Charlotte, N.C., cautioned growth is set to slow sharply in the fourth quarter and new COVID cases pose a downside risk.

“Although this is an eye-popping number, it came as little surprise because previously released monthly data indicated that real GDP would likely grow at a record pace in the third quarter,” Bryson said. “Nevertheless, the level of real GDP still remains 3.5% below its peak in Q4-2019. In other words, the size of the American economy at present is 3.5% smaller than it was immediately before the COVID pandemic struck the economy.”