Single-Family Rents Bounce Back

Illustration Courtesy of CoreLogic

CoreLogic, Irvine, Calif., said single-family rent growth gained strength in September but remains below pre-pandemic rates.

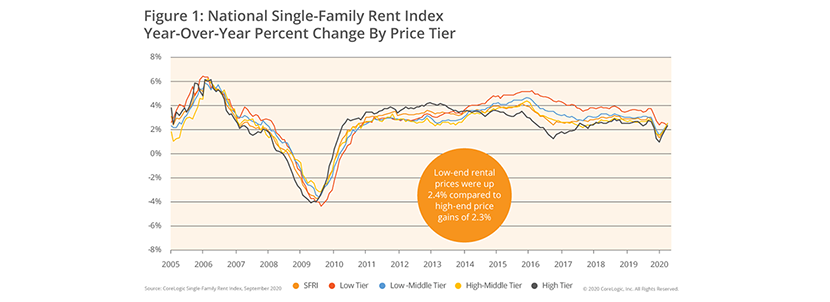

The CoreLogic Single-Family Rent Index showed a 2.5 percent year-over-year national rent increase, down from a 3 percent year-over-year increase in September 2019. Single-family rent prices regained strength in September and were just half a percentage point shy of their pre-pandemic national growth rate.

“The strength in rent growth was driven primarily by mid-to-high priced rentals, which have regained their lost momentum in late spring,” said CoreLogic Principal Economist Molly Boesel.

Boesel noted lower-priced rentals remain the furthest below their early 2020 growth rates, calling it a sign that many lower-income households may be struggling to meet rent payments.

CoreLogic said the rental market faced a “tumultuous journey” this year, including during June when the market saw the lowest annual growth rate for single-family rent prices in 10 years. “While national rent prices picked up pace in the late summer, September data shows a divide in recovery across price tiers,” the report said.

Arbor, Uniondale, N.Y., also found cause for SFR sector optimism. “[SFR] rent collections are reportedly holding in line with 2019 levels, occupancy rates have reached generational highs and rent growth pressures for vacant-to-occupied units have firmed,” the firm said in its third-quarter Single-Family Rental Investment Trends report.

Arbor noted loan-to-value ratios on SFR mortgages fell slightly in the third quarter, but said year-over-year LTVs are up a significant 330 basis points. “Lenders traditionally tend to pull back in recessionary periods and are more conservative in their underwriting, accounting for the added risk of asset devaluations and borrower defaults,” the report said. “However, thus far in the COVID-19 recession, there is little evidence of widespread housing market distress. Moreover, in many places around the country, housing prices are incredibly tight as urban outmigration pours into adjacent suburbs. High occupancy figures, coupled with resilient asset valuations, are likely supporting confidence in the SFR sector’s stability, preventing any significant downward pressure on LTVs.”

The single-family rental sector is likely on of the best-positioned asset class for growth during the pandemic, Arbor said. “SFR’s favorable counter-cyclical profile has combined with a confluence of demographic and migration factors, boosting tenant demand and retention,” the report said. “A market inflection in tenant performance is unlikely, though some deterioration remains possible. Still, despite the presence of transitory risks, SFRs enjoy a critical balance of favorable factors likely to support the subsector’s economics over the short- and long-term.”