Industrial, Apartment Prices Rise as Retail, Office Continue Fall

Price gains in the high-flying apartment and industrial sectors offset declining retail and office property prices in October, reported Real Capital Analytics, New York.

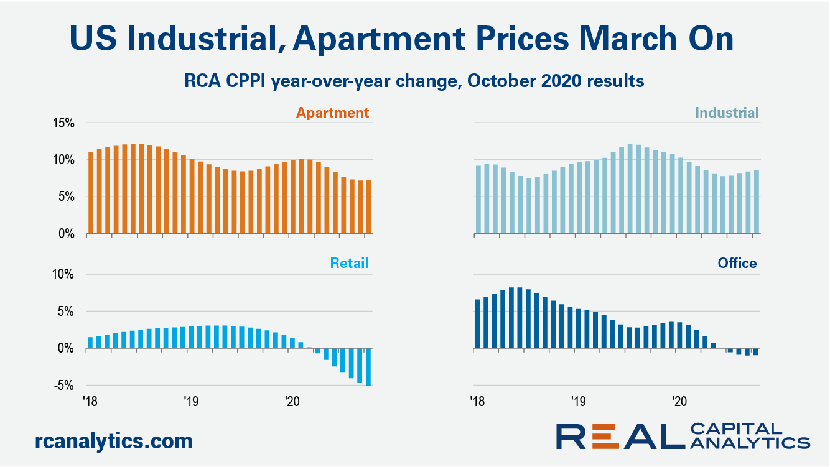

The RCA National All-Property Index rose 3.6 percent from a year ago and 1.2 percent overall for the month. The industrial index once again saw the highest annual growth rate in October, gaining 8.5 percent over the last year. “Industrial prices have slowly begun to increase again since the middle of this year after a steady waning from double-digit highs seen in mid-2019,” said RCA Senior Analyst Wyatt Avery.

Apartment prices increased 7.2 percent from a year ago. Avery said multifamily was one of the more stable asset types during the current economic and health crisis, largely due to activity in the secondary and tertiary markets. For the year to date, apartment deal volume is down 40 percent–only the industrial sector has posted a shallower drop in volume.

Retail property prices fell again in October, down 0.5 percent from September and down 5.2 percent over the past year. “The already struggling sector was the first to register the price impact of COVID-19, as annual trends turned negative in April,” Avery said. “Returns in the sector are currently at a low not seen since the end of 2010.”

The office sector continued to fall at about a 1 percent annual rate, RCA said.

Green Street, Newport Beach, Calif. reported its price index of real estate investment trust-owned properties increased by 0.4 percent in October.

“For properties where fundamentals still look pretty good or where there is a solid credit and plenty of lease term, low interest rates have caused pricing to firm up; in some cases–industrial is a prime example–values are higher than they were before the pandemic,” said Green Street Managing Director Peter Rothemund.

Prices fell for other REIT-owned assets. “The magnitude of the ultimate decline is going to depend on property type, location, rent level, etc.,” Rothemund said. “With buyers looking for a bargain and sellers hoping for the best, not much has been trading.”

RCA noted pricing in non-major metros has held up better than in the six largest metros ever since March. In October, the firm’s non-major index posted a 4.2 percent annual rate compared to a 2.0 percent gain in the major metros.