MBA: Upward Revisions to 2020, 2021 Mortgage Forecasts

The most volatile and unpredictable economy in a decade has produced the strongest housing market in more than a decade—and, according to the Mortgage Bankers Association, it could get even stronger.

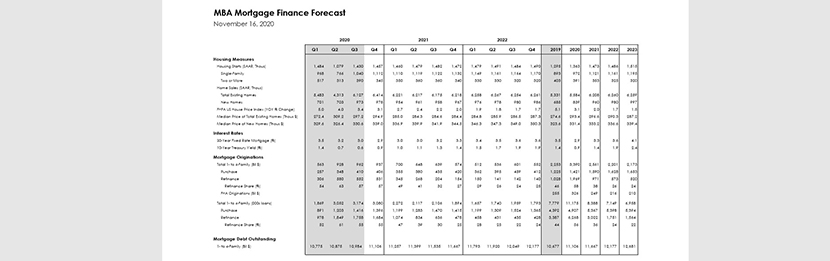

The latest MBA Mortgage Market Forecast and Economic Forecast sees better than expected incoming data resulting in upward revisions to its 2020 and 2021 originations estimates. Total 2020 mortgage originations are now expected to reach $3.39 trillion, an upward revision from the $3.175 trillion forecasted in October. This represents a 50% increase from 2019 ($2.25 trillion) to the highest level since 2003 ($3.81 trillion).

With interest rates hitting record lows for most of the past six weeks, MBA projects refinance originations are expected to jump by 91.5% in 2020 to $1.97 trillion, the highest since 2003 ($2.53 trillion). Purchase originations in 2020 are forecast to increase by 16% to $1.42 trillion, the highest level since 2005 ($1.51 trillion).

And for purchase originations, that’s just the start. MBA now projects given the strong pace of home sales, purchase originations in 2021 are now expected to rise to $1.59 trillion, which would eclipse the previous record high of $1.51 trillion in 2005. Refinance originations, on the other hand, are projected to slow next year to $971 billion as mortgage rates, which should finish 2020 at 2.9 percent, rise to 3.3 percent in 2021.

Together, MBA said 2021 mortgage originations are expected to fall to $2.56 trillion, which would still make it the second-highest total in the past 15 years.

MBA also expects the economy to stabilize in 2021. After an overall decline of 2.5% in 2020—following a summer that saw wild fluctuations of minus 33 percent to plus 31 percebt, the economy is expected to rebound in 2021 and expand to a growth rate of 3%. Additionally, the unemployment rate is expected to improve more rapidly, reaching the 5% mark by the end of 2021.

MBA also revised upward third quarter total origination volume from $860 billion to $962 billion; and fourth quarter volume from $824 billion to $937 billion.