Initial Claims Tapering, But Remain High

Nearly three million Americans applied for initial unemployment claims last week—the lowest level in eight weeks but still highly elevated in the wake of the coronavirus pandemic.

The Labor Department yesterday said 2.981 million people applied for unemployment claims for the week ending May 9, bringing the total of unemployed Americans since the start of the pandemic eight weeks ago to 36.5 million.

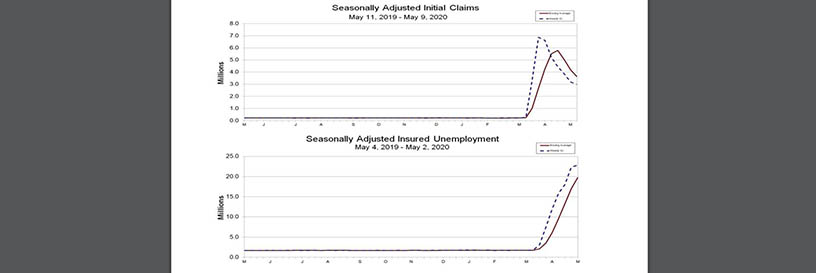

Last week’s claims fell by 195,000 from the week ending May 2 and fell for the sixth straight week. The four-week moving average fell to 3.615 million, a decrease of 564,000 from the previous week. The advance seasonally adjusted insured unemployment rate rose to 15.7 percent for the week ending May 2, an increase of 0.3 percentage point from the previous week’s revised rate.

Additionally, the report said the advance number for seasonally adjusted insured unemployment during the week ending May 2 rose to 22.83 million, an increase of 456,000 from the previous week’s revised level. The four-week moving average rose to 19.76 million, an increase 2.7 million from the previous week’s revised average.

Labor said the total number of people claiming benefits in all programs for the week ending April 25 was 25.37 million, an increase of 6.44 million from the previous week. This compares sharply from a year ago, when just 1.66 million claimed benefits in all programs.

“This was worse than consensus, as the rate of decay in new claims has declined,” said Jay Bryson, Acting Chief Economist with Wells Fargo Securities, Charlotte, N.C. “We note, however, that continuing claims just barely rose.”

Bryson said the persistence of seven-digit initial claims figures is “discouraging,” but noted a bright spot—continuing claims, which lag a week, were essentially flat, at 22.8 million. “Continuing claims serve as a gauge of (1) how quickly the economy can ramp up after states ‘re-open’ and (2) the efficacy of the [Paycheck Protection Program]. The plateau in continuing claims is an early sign that employers are calling back employees. New hires nearly offset layoffs.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., noted while last week’s figures continue to trend downward from a peak of 6.9 million on March 28, “claims still remain at historically elevated levels and continue to illustrate the unprecedented degree of labor market disruption being registered via reduced economic activity and falling consumer confidence due to the ongoing COVID-19 outbreak.”

“As with the prior weeks, a few caveats make this week’s data difficult to interpret precisely,” Duncan said. “On one hand, unemployment insurance eligibility rules have been relaxed recently, increasing the number of people who are able to apply. This makes it difficult to estimate the uninsured unemployed share of the workforce. On the other hand, many states reported a significant backlog of unemployment insurance applications due to a lack of processing capacity, indicating that this week’s release may understate the true extent of insured layoffs.”