S&P Reports Home Prices ‘Steady’ Amid Economic Volatility

Home prices continued to increase at a modest rate this spring, according to the S&P CoreLogic Case-Shiller Home Price Indexes.

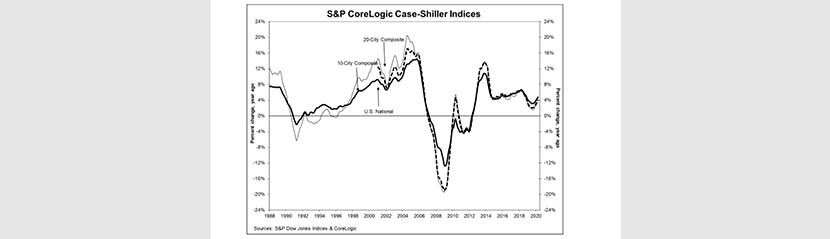

The report said the U.S. National Home Price NSA Index reported a 4.7% annual gain in April, up from 4.6% in March. The 10-City Composite was unchanged at 3.4%; the 20-City Composite (minus Detroit, whose data were delayed) posted a 4.0% year-over-year gain, up from 3.9% in March.

Phoenix, Seattle and Minneapolis reported the highest year-over-year gains among the 19 cities (excluding Detroit), with year-over-year price increases of 8.8%, 7.3% and 6.4% respectively. Twelve of the 19 cities reported higher price increases for the year ending April from a year ago.

Month over month, the National Index posted a 1.1% increase while the 10-City Composite posted an 0.7% gain and the 20-City Composite posted an 0.9% increase before seasonal adjustment. After seasonal adjustment, the National Index posted an 0.5% gain while the10-City and 20-City Composites both posted 0.3% gains. Sixteen of 19 cities reported increases before and after seasonal adjustment.

“April’s housing price data continue to be remarkably stable,” said Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy with S&P Dow Jones Indices. “April’s year-over-year gains were ahead of March’s, continuing a trend of gently accelerating home prices that began last fall.”

Selma Hepp, deputy chief economist for CoreLogic, noted while actions to mitigate the pandemic have varied, everyone has been affected by COVID-19 – and the impact has not been even across local economies or housing markets. “Nevertheless, some of the tailwinds that supported the demand coming into 2020, such as demographics and low mortgage rates, remain intact and may even accelerate demand,” she said. “Still, supply headwinds, such as declining for-sale inventories, will continue to keep a lid on the number of transactions but also push up home price growth.”

The report said measured from its June 2006 peak, the 10-City Composite is up by 4.5%. The 20-City Composite eclipsed its July 2006 peak by 8.5%; and the National Index is up 17.9% from its July 2006 peak.