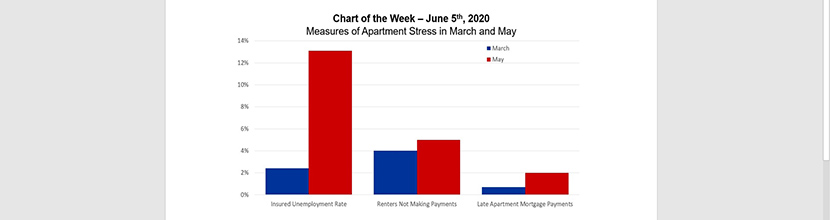

MBA Chart of the Week: Measures of Apartment Stress in March and May

There has been an important disconnect between the labor market and apartment markets over the last two months.

The labor market is currently seeing historic levels of stress, with the April jobs report showing a decline of 20 million jobs. The just-released May numbers were unexpectedly positive, but still leave the job market 13 percent smaller than pre-COVID-19 levels, with a high unemployment rate of 13 percent. The most recent weekly unemployment insurance claims reveal that the number of people receiving unemployment insurance jumped to 13.1 percent of the covered labor force as of May 16, up from 2.4 percent as of March 21.

But that same level of, and increase in, stress has not transmitted to the apartment market. A gauge from the National Multifamily Housing Council of the share of renters making their monthly payments shows only a small fall-off in recent months – with 95 percent making their payments in April, down 3 percentage points from a year earlier. Through the 27th of the month, May collections were running two percentage points ahead of April. With that relative strength in rent payments, most apartment property investors are also making their mortgage payments, with 2 percent of mortgage payments late as of April 20, compared to just less than 1% in March.

What explains the disconnect? In all likelihood, the substantial stimulus from the federal government. The CARES Act and other federal programs have provided unprecedented financial support to households. In April, U.S. personal income jumped a massive 10.5 percent on a monthly basis, more than double the previous record–even while compensation fell 8 percent. Government social benefits jumped 90 percent to a record (by far) $6.3 trillion seasonally adjusted annual rate.

–Jamie Woodwell jwoodwell@mba.org; Reggie Booker rbooker@mba.org.