CoreLogic: Mortgage Delinquencies Hit Downslope

CoreLogic, Irvine, Calif., said April early stage mortgage delinquencies jumped to levels that exceeded even those during the Great Recession.

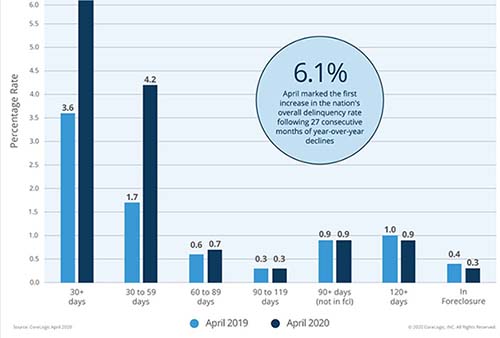

The company’s monthly Loan Performance Insights Report said after 27 consecutive months of declines, the nation’s overall delinquency rate jumped to 6.1% in April, a 2.5-percentage point increase in the overall delinquency rate compared to March, when it was 3.6%. The delinquency rate reached its highest level since January 2016.

The share of mortgages that transitioned from current to past due reached its highest level in at least 21 years, exceeding the previous peak from November 2008.

The report said early-stage delinquencies (30 to 59 days past due) rose to 4.2%, up from 1.7% a year ago. Adverse delinquency (60 to 89 days past due) increased slightly to 0.7%, up from 0.6% a year ago. The serious delinquency (90 days or more past due, including loans in foreclosure) rate dipped slightly, however, to 1.2%, down from 1.3% a year ago. For the fifth consecutive month, the serious delinquency rate remained at its lowest level since June 2000.

CoreLogic said the foreclosure inventory rate (the share of mortgages in some stage of the foreclosure process) fell to 0.3%, down from 0.4% a year ago. This is the lowest foreclosure rate for any month since at least January 1999. The transition rate (the share of mortgages that transitioned from current to 30 days past due) rose to 3.4%, up from 0.7% a year ago, marking the highest rate since at least January 1999. In January 2007, just before the start of the financial crisis, the current- to 30-day transition rate was 1.2%, while it peaked in November 2008 at 2%.

All states logged increases in overall delinquency rates in April. New York and New Jersey were both hot spots for the virus and experienced the largest overall delinquency gains of 4.7 and 4.6 percentage points respectively in April, compared to one year earlier. Nevada, Florida and Hawaii were hit hard by the collapse in business travel and tourism, posting spikes of 4.5, 4.0 and 3.7 percentage points, respectively.

On the metro level, tourism destinations such as Miami (up 6.7 percentage points); Kahului, Hawaii (up 6.2 percentage points); New York City (up 5.5 percentage points); Atlantic City, N.J. (up 5.4 percentage points) and Las Vegas (up 5.3 percentage points), led the nation in overall delinquency gains.

CoreLogic Chief Economist Frank Nothaft noted unemployment reached its highest level in more than 80 years in April, reducing affected homeowners’ ability to make monthly mortgage payments. “The resurgence of COVID-19 infections across the country has created economic uncertainty and leaves those who are unemployed concerned with their ability to make monthly mortgage payments,” he said.

Nothaft noted the latest forecast from the CoreLogic Home Price Index predicts prices declining in all states through May 2021, erasing some home equity and increasing foreclosure risk.

“Despite the scale and suddenness of the pandemic, mortgage delinquency has yet to emerge as a major issue, thanks to government COVID-19 relief programs and other housing finance industry efforts,” said Frank Martell, president and CEO of CoreLogic. “As the true impact of the economic shutdown during the second quarter of 2020 becomes clearer, we can expect to see a rise [in] delinquencies in the next 12-18 months — especially as forbearance periods under the CARES Act come to a close.”