MBA: Share of Mortgage Loans in Forbearance Decreases for Third Straight Week to 8.39%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 8 basis points to 8.39% of servicers’ portfolio volume as of June 28, compared to 8.47% the prior week. MBA estimates nearly 4.2 million homeowners are in forbearance plans.

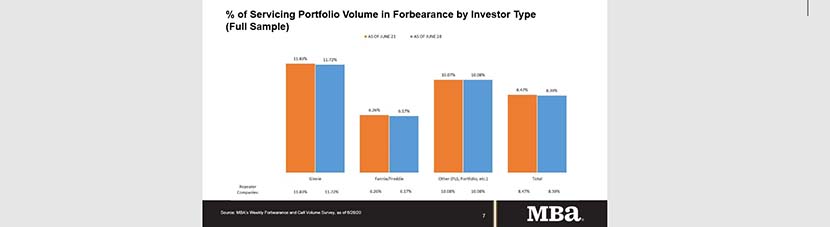

The share of Fannie Mae and Freddie Mac loans in forbearance dropped for the fourth consecutive week to 6.17%, a 9-basis-point improvement. Ginnie Mae loans in forbearance decreased by 11 basis points to 11.72%. The forbearance share for portfolio loans and private-label securities increased by 1 basis point to 10.08%. The percentage of loans in forbearance for depository servicers dropped to 9.03%, while the percentage of loans in forbearance for independent mortgage bank servicers decreased to 8.33%.

“We learned last week that the job market improved more than expected in June,” said MBA Chief Economist Mike Fratantoni. “With that as background, it is not surprising that the forbearance numbers continue to improve as more people go back to their jobs. The improvement in the forbearance data was broad-based, with declines for both GSE and Ginnie Mae loans. The decrease in new forbearance requests indicates that further declines are likely in the weeks ahead.”

Fratantoni also noted a “higher share exiting into deferral options and modifications, and somewhat fewer simply opting out of a forbearance plan.”

Key findings of MBA’s Forbearance and Call Volume Survey – June 22-28:

• Total loans in forbearance decreased by 8 basis points relative to the prior week: from 8.47% to 8.39%.

o By investor type, the share of Ginnie Mae loans in forbearance decreased from 11.83% to 11.72%.

o The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior week: from 6.26% to 6.17%.

o The share of other loans (e.g., portfolio and PLS loans) in forbearance increased relative to the prior week: from 10.07% to 10.08%.

• Forbearance requests as a percent of servicing portfolio volume (#) decreased across all investor types: from 0.14% to 0.12%.

• Weekly servicer call center volume:

o As a percent of servicing portfolio volume (#), calls decreased from 7.8% to 6.8%.

o Average speed to answer increased relative to the prior week from 1.8 minutes to 1.6 minutes.

o Abandonment rates decreased from 5.5% to 5.0%.

o Average call length increased from 7.0 minutes to 7.5 minutes.

• Loans in forbearance as a share of servicing portfolio volume (#) as of June 28, 2020:

o Total: 8.39% (previous week: 8.47%)

o IMBs: 8.33% (previous week: 8.42%)

o Depositories: 9.03% (previous week: 9.09%)

MBA’s latest Forbearance and Call Volume Survey covers the period from June 22-28 and represents 76% of the first-mortgage servicing market (38.2 million loans).