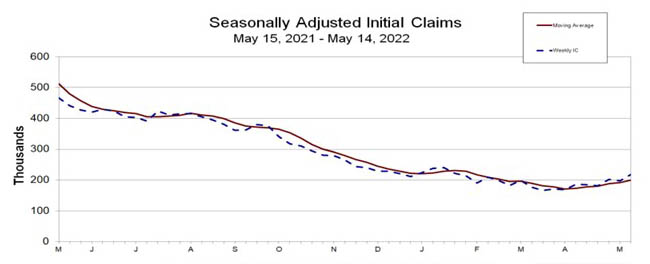

Initial Claims Rise for 2nd Straight Week

Initial claims for unemployment insurance rose for the second straight week, the Labor Department reported Thursday.

For the week ending May 14, the advance figure for seasonally adjusted initial claims rose to 218,000, an increase of 21,000 from the previous week, which revised down by 6,000 from 203,000 to 197,000. The four-week moving average rose to 199,500, an increase of 8,250 from the previous week’s revised average.

The advance seasonally adjusted insured unemployment rate fell to 0.9 percent for the week ending May 7, a decrease of 0.1 percentage point from the previous week’s unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending May 7 fell to 1,317,000, a decrease of 25,000 from the previous week’s revised level to its lowest point since December 27, 1969, when it was 1,304,000. The four-week moving average fell to 1,362,250, a decrease of 22,500 from the previous week’s revised average to its lowest level since January 24, 1970, when it was 1,361,000.

The advance number of actual initial claims under state programs, unadjusted, totaled 198,711 in the week ending May 14, an increase of 12,811 (6.9 percent) from the previous week. The seasonal factors had expected a decrease of 6,111 (3.3 percent) from the previous week. Labor reported 451,302 initial claims in the comparable week in 2021.

The advance unadjusted insured unemployment rate fell to 0.9 percent during the week ending May 7, a decrease of 0.1 percentage point from the prior week. The advance unadjusted level of insured unemployment in state programs totaled 1,285,490, a decrease of 48,063 (3.6 percent) from the preceding week. The seasonal factors had expected a decrease of 24,149 (1.8 percent) from the previous week. A year earlier the rate was 2.6 percent; volume was 3,666,448.

The total number of continued weeks claimed for benefits in all programs for the week ending April 30 was 1,371,448, a decrease of 68,885 from the previous week. Labor reported 15,970,923 weekly claims filed for benefits in all programs in the comparable week in 2021.