MBA Chart of the Week: CMBS Annual Issuance Volume

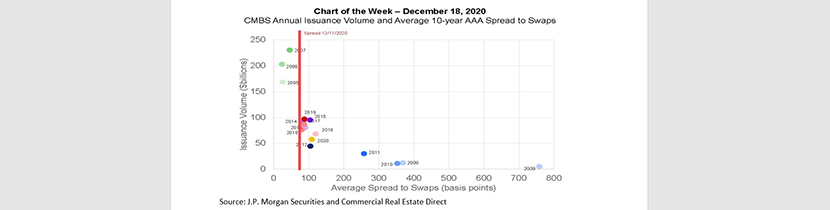

One way to gauge potential commercial mortgage-backed securities issuance volume is by looking at the spreads investors are willing to pay for bonds. Based on current new-issue spreads, 2021 could line-up to be a strong year.

The spreads investors demand to invest in CMBS are a measure of capital supply. Strong investor appetite, as was seen during 2005, 2006 and 2007, can drive spreads tighter and issuance volumes higher. In 2006, 10-year AAA CMBS spreads averaged 24 basis points, pushing issuance volume above $200 billion. Similarly, weak demand can edge spreads higher and issuance lower, as was seen in 2011, when the market was still recovering from the Global Financial Crisis. Spreads averaged 258 basis points, and issuance trickled out at $30 billion.

For most of the last decade, the average annual spread between swaps and 10-year AAA CMBS bonds has been more range bound, averaging between 85 and 120 basis points each year from 2012 to 2020. Issuance followed, ranging from $44 billion to $97 billion. As we close out 2020, AAA spreads have fallen from 275 basis points in March to 73 basis points in mid-December, tighter than any annual average since 2007.

But any constraints on issuance this year may be driven more by demand for (reasonable) mortgage debt than by the supply coming from investors. Uncertainty about the operations, values and finance-ability of some properties – in particular certain malls and hotels – may limit the universe of loans that can be made. And competition among different capital sources to fund stronger properties – right now multifamily and industrial – may make it harder to win some of those deals. Tighter spreads can certainly help CMBS in the latter case – as can increased clarity about the impact of vaccines in the former.

2021 brings with it a great deal of uncertainty and change – including a difficult winter before the promise of widespread vaccination. If today’s spreads are any indication, some of that change may prove positive for the CMBS market.

–Jamie Woodwell jwoodwell@mba.org