CoreLogic: October Delinquency Rate Hits 20-Year Low

CoreLogic, Irvine, Calif., reported 3.7% of mortgages were in some stage of delinquency in October, an 0.4 percentage point decline from a year ago.

The company’s monthly Loan Performance Insights Report also said the foreclosure inventory rate fell to 0.4%, down 0.1 percentage points from a year ago, tying the prior 11 months as the lowest for any month since at least January 1999.

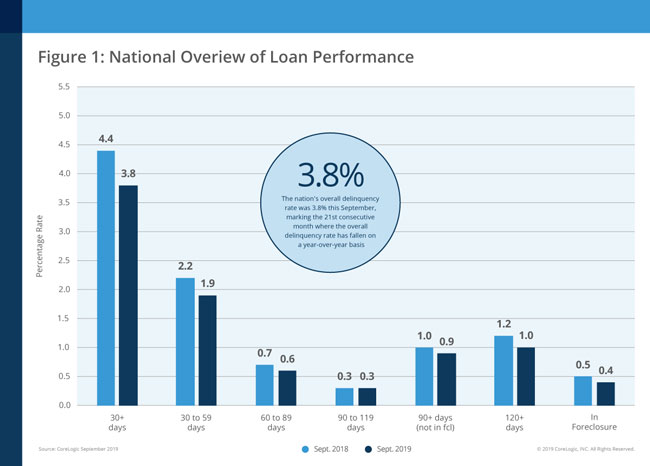

The rate for early-stage delinquencies (30-59 days past due) fell to 1.8% in October, down from 1.9% a year ago. The share of mortgages 60-89 days past due in October fell to 0.6%, down from 0.7% a year ago. The serious delinquency rate (90 days or more past due, including loans in foreclosure) fell to 1.3% in October, down from 1.5% a year ago. The serious delinquency rate has remained consistent since April 2019.

The report said the share of mortgages that transitioned from current to 30 days past due was unchanged at 0.7% in October. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2%, while it peaked at 2% in November 2008.

“Home price growth builds homeowner equity and reduces the likelihood of a loan entering foreclosure,” said Frank Nothaft, chief economist with CoreLogic. “The national CoreLogic Home Price Index recorded a 3.3% annual rise in values through October 2019, and price growth was the primary driver of the $5,300 average gain in equity reported in the latest CoreLogic Home Equity Report.”

No states posted a year-over-year increase in the overall delinquency rate in October 2019. States that logged the largest annual decreases included North Carolina (down 0.9 percentage points) and Mississippi (down 0.8 percentage points). Eight other states followed with annual decreases of 0.6 percentage points.

The report said eight metropolitan areas in the Midwest and South recorded small annual increases in overall delinquency rates: Pine Bluff, Ark. (1.0 percentage points); Dubuque, Iowa (0.2 percentage points) and Rockford, Ill. (0.2 percentage points). Five other metros rose by 0.1 percentage points: Columbus, Ind.; Kokomo, Ind.; Manhattan, Kan.; Oshkosh-Neenah, Wis.; and La Crosse-Onalaska, Wis.-Minn.

CoreLogic said while the nation’s serious delinquency rate remains at a 14-year low, 14 metropolitan areas recorded small annual increases in their serious delinquency rates. Metros with the largest increases were Panama City, Fla. (0.4 percentage points) and Dubuque, Iowa (0.2 percentage points). The remaining 12 metro areas each logged an annual increase of 0.1 percentage point.

“National foreclosure and serious delinquency rates have remained fixed at record lows for at least the last six months,” said Frank Martell, president and CEO of CoreLogic. “However, as markets can be much more volatile at the metro level, both late-stage delinquencies and foreclosures have continued to increase at this level in the Midwest and Southern regions of the country.”