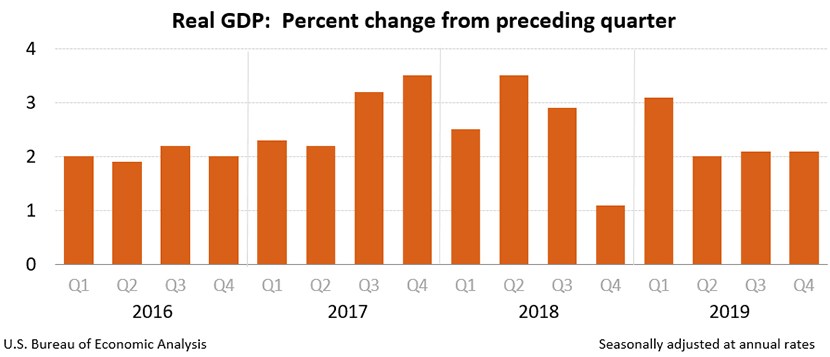

4th Quarter GDP Up 2.1%

Real gross domestic product increased at an annual rate of 2.1 percent in the fourth quarter, unchanged from the third quarter, according to the first (advance) estimate released yesterday by the Bureau of Economic Analysis.

BEA said the increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures, federal government spending, state and local government spending, residential fixed investment and exports, partly offset by negative contributions from private inventory investment and nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, decreased).

The report said a downturn in imports, an acceleration in government spending and a smaller decrease in nonresidential investment were offset by a larger decrease in private inventory investment and a slowdown in PCE.

For the year, BEA said real GDP increased by 2.3 percent from 2018, compared to an increase of 2.9 percent in 2018. The increase in real GDP in 2019 reflected positive contributions from PCE, nonresidential fixed investment, federal government spending, state and local government spending, and private inventory investment, partly offset by negative contributions from residential fixed investment. Imports increased.

The deceleration in real GDP in 2019, compared to 2018, primarily reflected decelerations in nonresidential fixed investment and PCE and a downturn in exports, partly offset by accelerations in both state and local and federal government spending. Imports increased less in 2019 than in 2018.

“The pace of GDP growth in Q4 remained modest, and we look for further slowing in Q1-2020,” said Jay Bryson, Global Economist with Wells Fargo Securities, Charlotte, N.C. “That said, the underlying fundamentals of the economy generally remain solid.”

Bryson noted the labor market remains very strong, which continues to create real income, and the financial health of the household sector has improved markedly over the past decade. “That said, a shock could potentially lead to some economic weakness in the United States, and we are watching the outbreak of the coronavirus closely to determine what effects, if any, it has for the U.S. economy,” he said.