MBA Chart of the Week: Where from Here? One Scenario

On Sunday, we kicked off CREF 2020–MBA’s 2020 Commercial Real Estate Finance/Multifamily Housing Convention & Expo, with an economic and mortgage market update. One of the main messages: the commercial/multifamily markets ended 2019 on a very strong note.

But that’s last year, and we know much of the conference will be focused on how the industry should think about the year ahead.

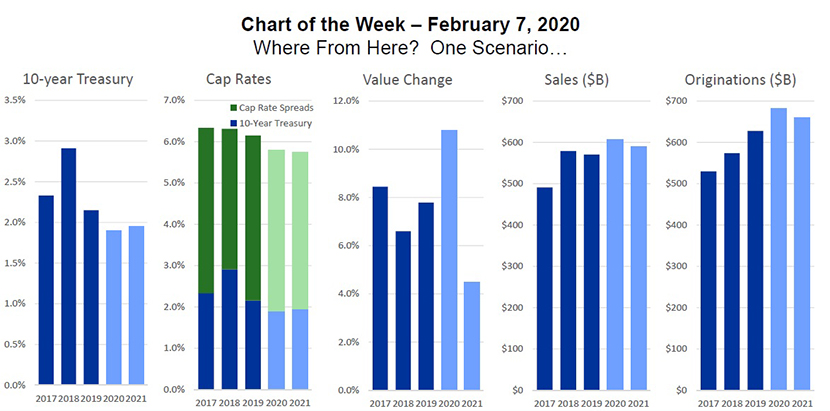

At the beginning of January, we released an updated CREF Forecast (https://www.mba.org/2020-press-releases/january/forecast-commercial/multifamily-lending-to-climb-9-percent-to-683-billion-in-2020), which calls for an anticipated 9 percent increase in borrowing and lending this year–surpassing last year as the new record for commercial mortgage originations. At the heart of our thinking is the expectation that interest rates and yields will stay “lower for longer.”

One can think of originations as the output of an economic model driven by interest rates and returns. After averaging 2.9 percent in 2018, the 10-year Treasury averaged 2.1 percent in 2019. In 2020, it is expected to average 1.9 percent–today it currently stands below 1.7 percent. While capitalization rates do not always follow interest rates, continued investor demand for commercial real estate, coupled with lower overall yields, is likely to put downward pressure on cap rates, which should in turn boost property values. Over the past 20 years, we have seen a strong correlation between property prices and price changes, and property sales and originations activity. Thus, our forecast for another increase in overall borrowing and lending activity this year.

Looking out to 2021, our forecast anticipates a (slight) increase in Treasuries, which will tamp down some of the tailwinds for growth. But absent market disruptions, we still anticipate a strong year.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org.)