#MBAIMB20: MBA Carries Torch for IMBs

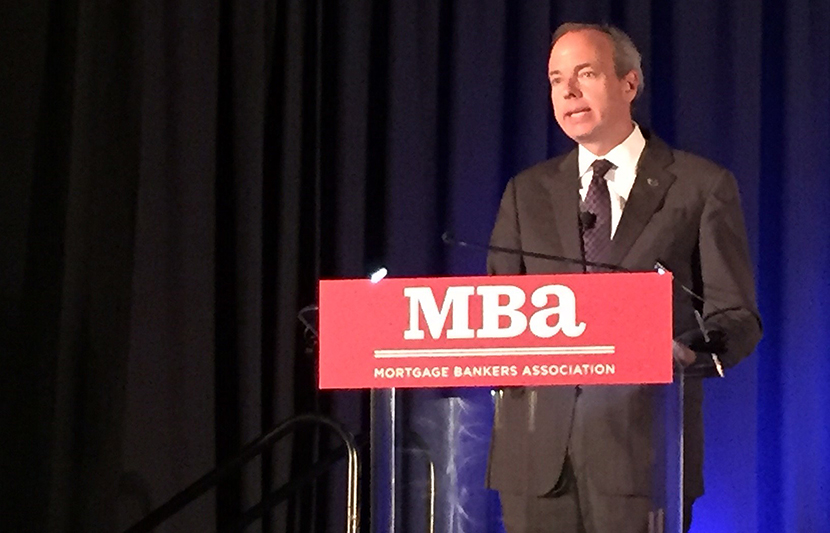

NEW ORLEANS—Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, has worked for, and with, independent mortgage bankers. For him–and for MBA–it’s an easy sell.

“I know the long and storied history of the independent mortgage bank,” Broeksmit said here at the MBA Independent Mortgage Bankers Conference. “You’ve provided loans to the people who have needed them for more than 140 years. You financed Midwestern agriculture in its earliest days. You led the shift to single-family housing at the turn of the 20th century. And today, more than a century later, you’re the main source of high-quality, sustainable mortgage credit for families across the country.”

Without IMBs, Broeksmit said, millions of low- and moderate-income families would not obtain mortgages. “Without you, they’d never get the chance to make a home their own, and everything that entails. Veterans, rural Americans, minorities, hardworking families in every city and every state—they depend on you, and you don’t let them down.”

Broeksmit noted that production gets attention on Capitol Hill, too. “When we sit down with a lawmaker, a regulator or pretty much anyone else in Washington, we tell your story,” he said. “We provide them with data showing what you do: more than 80 percent of FHA loans; nearly two-thirds of loans to minority borrowers and 60 percent of loans to low- and moderate-income borrowers come from IMBs. It’s a great story and we love to tell it. Every trade association in Washington wishes they had members as in-demand as you. Frankly, you make it easier to get results.”

This week, MBA will release a new report, “The Rising Role of the Independent Mortgage Bank,” to serve as a go-to resource for policymakers and others who want or need to learn more about IMBs (https://www.mba.org/audience/residential-mortgage-professionals/independent-mortgage-banks-financing-the-american-dream).

“Anyone who reads this report will come away with a deeper appreciation for IMBs,” Broeksmit said. “Across the board, we’re helping the movers and shakers understand your impact. We’re also helping them recognize your needs.”

In 2020, Broeksmit said MBA will engage in a number of advocacy initiatives for IMBs.

“It starts with the relationships we’ve forged,” Broeksmit said. “We meet regularly with Congress, the Consumer Financial Protection Bureau, the Federal Housing Finance Agency, Ginnie Mae and Treasury to discuss our perspective on how to ensure a stable, robust housing financial market experience of our staff, we bring your expertise. And we bring focused and common-sense policy solutions, not self-serving arguments. And they listen.”

Broeksmit noted recent meetings with the Financial Stability Oversight Council and Treasury outlined the important role IMBs play in the market. “We’re beating the drum that IMBs don’t pose excessive risk,” he said. “Any action [by regulators] must protect taxpayers, be prudent on counterparty risk and preserve the market. Disruption would e disastrous, for communities and the economy. Your businesses and borrowers are counting on stability, and we won’t let you down.”

Broeksmit emphasized that MBA is the IMBs’ biggest ally. “We are your biggest fans,” he said. “We educate America about what you do. We advocate for your priorities at every level. We advocate for your priorities every day, in more ways than I can count. At the end of the day, we know this isn’t just about business for you. This is your passion. The men and women who run independent mortgage banks are the pillars of your communities. You’re dedicated local leaders who strengthen the economy and countless families. You do well by doing good.”