MBA Chart of the Week: Estimates of New Home Sales

Want to get an early read of the U.S. Census Bureau’s monthly release of new home sales? Start following MBA’s estimates on new home sales in the monthly release of the Builder Application Survey.

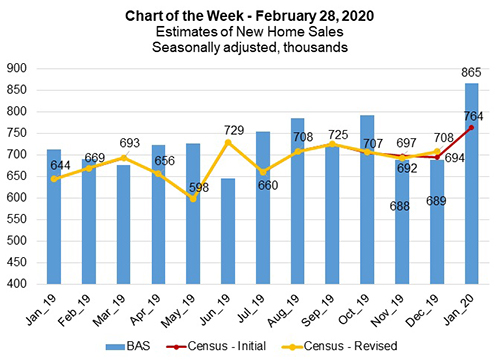

Last week, the Census Bureau said new home sales surged 7.9 percent in January to a seasonally adjusted annual rate of 764,000–the strongest pace of new sales since July 2007. This comes as no surprise if you saw the January BAS release two weeks ago.

Using the BAS, which comprises mortgage affiliates of home builders and thus tends to be more representative of the activity of larger home builders, MBA publishes trends on applications for new home purchases as well as estimates of new home sales. Our survey is estimated to cover more than 30 percent of the new home sales market, and we typically release our results within the first two weeks of each month.

We believe the BAS new home sales estimate has consistently provided an early indicator of the Census numbers. This week’s chart shows how the two series compared over 2019, and highlights that for the November and December, the Census revisions have remained close to the BAS estimates.

For example, the BAS showed 689,000 new home sales for December, and 11 days later, the Census released showed 694,000 units, which was revised to 708,000 units in its most recent release. Most recently, our estimate showed a large increase in home sales for January at an annualized pace of 865,000 units, and Census followed that with their estimate of 764,000 units.

Early 2020 has been good for home builders. Data on new residential construction and new home sales have started on a strong note, which has been a positive development for this inventory-strapped housing market. In addition to January’s big new home sales jump, single-family housing starts and permits have hit their highest levels since the mid-2000’s. Will this strong stretch continue? You may want to check the February BAS release–out in mid-March–for an accurate estimate.

(Mike Fratantoni is chief economist and senior vice president of research and economics with the Mortgage Bankers Association. He can be reached at mfratantoni@mba.org. Joel Kan is associate vice president of economic and industry forecasting with MBA; he can be reached at jkan@mba.org. Anh Doan is senior financial analyst with the Mortgage Bankers Association. She can be reached at adoan@mba.org.)