Mortgage Credit Availability at 4-Month High

Mortgage credit availability increased in November to its highest level since July, the Mortgage Bankers Association reported this morning.

The MBA Mortgage Credit Availability Index which analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool, rose by 0.7 percent to 122.2 in November, the second straight monthly increase after hitting a six-year low in September.

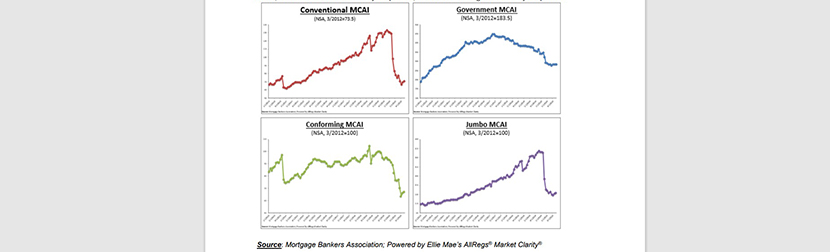

The Conventional MCAI increased by 1.3 percent, while the Government MCAI increased by 0.3 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.6 percent and the Conforming MCAI rose by 0.9 percent.

“Mortgage credit availability increased slightly in November to its highest level since July, as the job market improved, and the housing sector continued to show strong borrower demand,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecast. “There was an increase in credit availability for jumbo loans, as well as loan products with low credit scores, higher LTVs and adjustable-rate features.”

Kan noted home purchase and refinance activity have remained strong in recent months, and the increased credit supply should help qualified borrowers still looking to capitalize on record-low mortgage rates. “However, credit availability is still more than 30 percent below pre-pandemic levels and close to the restricted standards seen in 2014,” he said. “This has been especially impactful for government borrowers and first-time buyers.”

The MCAI analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

The Conventional, Government, Conforming and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index. The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

Expanded Historical Series

The Total MCAI has an expanded historical series, which gives perspective on credit availability going back 10 years (expanded historical series does not include Conventional, Government, Conforming or Jumbo MCAI). The expanded historical series covers 2004 through 2010, and was created to provide historical context to the current series by showing how credit availability has changed over the past 10 years–this includes the housing crisis and ensuing recession. Data prior to March 31, 2011, was generated using less frequent and less complete data measured at six-month intervals and interpolated in the months between for charting purposes. Methodology on the expanded historical series from 2004 to 2010 has not been updated.

About the Mortgage Credit Availability Index

The MCAI provides the only standardized quantitative index solely focused on mortgage credit.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for more than 95 lenders/investors are combined by MBA using data made available via the AllRegs Market Clarity product and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

To learn more about the Ellie Mae AllRegs Market Clarity platform visit http://answers.allregs.com/MCAI-Market-Clarity. For more information on the Mortgage Credit Availability Index, including Methodology, Frequently Asked Questions and other helpful resources, visit www.mba.org/MortgageCredit or contact MBAResearch@mba.org.