Fiorilla: Tourism Metros Slow to Recover from COVID

By Yardi Matrix Director of Research Paul Fiorilla

Tourism and energy were among the sectors to bear the early brunt of COVID-19, as shelter-in-place orders that started in March closed many office buildings and entertainment venues around the country. Less commuting and leisure travel cut demand for oil and prompted mass layoffs, especially in metros with concentrations in tourism and energy.

Nearly half of the 16.8 million leisure and hospitality workers in the U.S. were laid off or furloughed by May. Meanwhile, crude oil prices plummeted to negative levels in mid-April as oil producers were running out of storage space for oil that wasn’t being used. The loss of jobs was felt throughout the economy, including demand for multifamily, which has seen rent growth turn negative for the first time since 2009.

Nearly five months into the pandemic, the economy is slowly re-opening and metros with concentrations in tourism and energy have started to recover along with the rest of the country. Comparing employment, rent and occupancy data of a batch of metros, it appears metros with concentrations in energy have recovered better than tourism-centered metros.

To be sure, the economic impact of the pandemic may still be in its early stages and the relative performance of metros can change. But through July, energy-focused metros are performing better than tourism-focused metros in employment and rent growth metrics.

Metro Comparison

Our study looked at five metros in each category that have among the highest concentrations of employment in mining, logging and construction (energy) and leisure and hospitality (tourism). The five energy metros we used are Denver, Houston, Midland-Odessa, Oklahoma City and Pittsburgh. The five tourism metros in our study are Las Vegas, New Orleans, Orange County, Orlando and San Diego.

Nationally, the number of jobs fell by 13.3 million, or 8.8%, between March and June (which is the last month for which metro-level numbers are available), according to the Bureau of Labor Statistics. Year-over-year multifamily rent growth between March and July declined by 270 basis points, to -0.3% in July from 2.4% in March, according to Yardi Matrix.

All the five tourism-focused metros suffered job losses between March and June that were worse than the 8.8% national average (all employment data is from BLS). The steepest job losses came in Las Vegas (-13.5%, or 137,700 jobs), followed by Orlando (-11.6%, 180,500 jobs); New Orleans (-11.1%, 63,200 jobs); San Diego (-9.9%, 147,900); and Orange County (-9.7%, 158,987 jobs).

Only two of the energy-focused metros lost jobs between March and June at a rate worse than the national average. Midland-Odessa was the worst (-11.6%, 22,800 jobs), followed by Pittsburgh (-9.7%, 114,900 jobs); Denver (-7.4%, 150,400 jobs); Houston (-6.9%, 221,400 jobs); and Oklahoma City (-3.4%, 24,100 jobs).

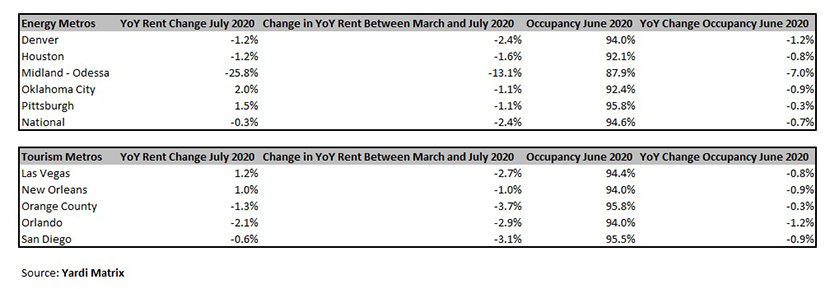

The weaker performance in total employment can be seen in asking rent growth numbers. Only one of the five energy metros saw a drop in rent growth that was more than the 2.7 percentage point national average decline, and only one of the tourism metros performed better than the national average (all rent data comes from Yardi Matrix).

Midland-Odessa, a small market in which 30% of total employment is in the energy sector, posted by far the worst performance. Asking rents in July are down 25.8% year-over-year, -13.1 percentage points below March’s level. Midland-Odessa has been struggling due to reduced oil exploration since crude prices began falling in October 2018. Multifamily rent growth in the metro has been negative for 12 months.

Other energy-focused metros were not as bad. Rent growth was still positive year-over-year in July in Oklahoma City (2.0%, 1.1 percentage points less than March) and Pittsburgh (1.5%, 1.1 percentage points less than March). Rent growth was negative in July in Denver (-1.2%, 2.4 percentage points less than March) and Houston (1.2%, 1.6 percentage points less than March).

Tourism-focused metros mostly saw bigger drops in asking rent growth between March and July. Asking rent growth remained positive in July in Las Vegas, at 1.2% year-over-year, although that was a 2.7% percentage point drop from March, and New Orleans (1.0%, 1.0 percentage points less than March). Year-over-year rent growth turned negative in Orlando (-2.1%, 2.9 percentage points less than March), Orange County (-1.3%, 3.7 percentage points less than March) and San Diego (-0.6%, 0.9 percentage points less than March).

Diversification Counts

What accounts for the better relative performance of energy than tourism metros? One reason may be that except Midland-Odessa, the energy metros have more diversified economies. As a share of employment, mining, logging and construction accounts for between 6.1% and 10.2% of jobs in the other four energy metros. Meanwhile, leisure and hospitality represent between 12.4% and 20% of jobs in the tourism metros.

While business and leisure travel have dropped considerably, energy prices have stabilized. West Texas Intermediate crude oil has traded in a range between $35 and $42 since late May, according to the U.S. Energy Information Administration. Many tourist attractions have re-opened but are carefully limiting crowds, and a second wave or outbreak could prompt a further shutdown.

Also up in the air is the government policy response. The $600 weekly increased unemployment benefits provided federal government through July helped keep apartment rents stable. The additional benefit has run out and it’s not if it will be renewed and if so, how much. The Democratic-led House of Representatives passed a bill in May to extend the payments, but the Republican-led Senate is trying to negotiate a smaller payment, which could impact rent growth in metros with high unemployment.

Longer-term factors also will come into play eventually. Metros from our energy (Houston and Denver) and tourism (Las Vegas and Orlando) lists have been among the fastest growing markets in the U.S. over the last decade. The growth of these metros is driven by affordable housing, an increase in skilled employment, and attractive lifestyle amenities, attributes that have only been temporarily put on hold by COVID-19.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)