Mark Dangelo: Beyond Digital Transformation—A Tale of What is Coming

Mark P. Dangelo is Chief Innovation Consultant with BlackFin Group, Laguna Hills, Calif., responsible for leading and managing innovation-led business transformation and technology projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of four innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

With the fading of those dreaded IBM green screens starting in the 1980s, management advisors and corporate leaders within the financial services and banking organizations have been struggling with digital transformation during the past several decades.

Early digital efforts were obviously needed to transform manual processes and paper-based delivery systems. Additionally, prior to digitization efforts, FSBOs experienced significant rework, widespread inefficiencies and data and financial errors which were pervasive and costly.

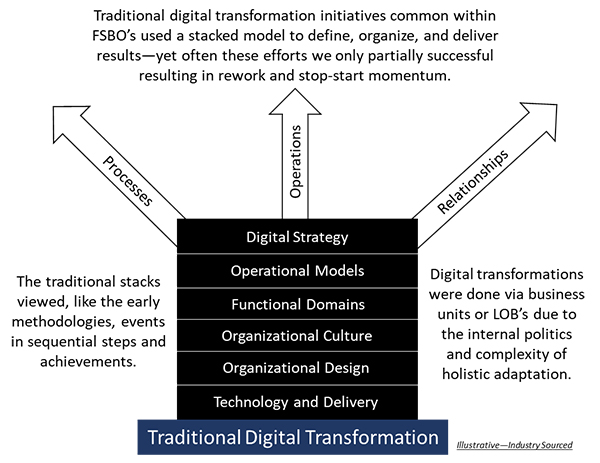

Now, after decades of layered digital initiatives (often point based and eschewing enterprise integrations), the acceleration of innovation (e.g., networking, apps, cross-industry linkages, big data, 5G, IoT, AI) has fragmented the approaches and segmentations recently viewed as a core competency by FSBOs and their consulting partners (as shown in the following conceptual diagram).

Yet, here we are in the second half of 2020 facing for those in the mortgage markets, volumes not experienced since 2007-2008. Many industry personnel would state that business is good, so do not mess it up.

However, skills needed to simply service the demands today cannot be found even though others within our FSBO may be under pressure from building risks, political influences, social pressures, and customer aversion to traditional products and services—nearly all which are digital, all delivered mobile, and all profitable until recently. Stating the obvious, as the consumer financial landscapes change, is that the use of digital and the delivery of data into multiple formats is no longer an option—it is a requirement to do business in any segment of financial services.

Some educational institutions and consultants now advocate we have entered a post-digital world. Perhaps. However, what is more likely outside this smart branding slogan, is that we are just using continuous innovation and large digital data volumes, cloud storage and sophisticated analytics to move us into the leveraging of digitalization programs. Let me be a bit crass when it comes to innovation today—process, technology, data, summarization, analytical, cash and currency, payments, security, privacy, compliance, synthetic intelligence—would we subscribe to anything but layers of integrated digital solutions?

We have expanded beyond monolithic, flat solutions into layered ones using emerging data sciences and technologies. Digital transformation is no longer something we do because we are in a FSBO and it helps our efficiencies and quality—instead, being digital and integrated across our enterprise is mandated by consumers seeking value-added benefits to aid their lives. So as risks increase due to consumer, political, and financial shifts, have we defined how our traditional digital investments are able to be leveraged moving forward? What are we expecting from them tomorrow? And, are we confusing digitization (i.e., data being in digital format) with digital transformation (i.e., the value proposition impacting processes, business models, partnerships and insights)?

The Digital Mirage

What is becoming apparent is that the fundamentals of digital transformations have evolved—the model has been fractured by the one group FSBOs were seeking to encapsulate, that is financial consumers. The old ways of digital transformation have lost their efficacy with a majority of FSBO leadership teams indicating in survey after survey they have mastered digitalization. Furthermore, consumers have shifted their idea of what financial services mean to them as many within the FSBOs think about digital projects—data usage and value versus availability.

And, for those FSBO’s with lending lines-of-business (LOBs), the pace and profitability of the last 12 months have not been this positive since 2007. Rates are low, originations are climbing, housing valuations rising, secondary market sales have the greatest margins since 2008, and refinancing is booming. The scarcity of resources to perform lending function is extensive as evidenced by lead times to fill jobs and rates being offered to potential employees and contractors.

Yet, Q2 2020 is the worst quarter on record for FSBOs since the Great Recession ended. The U.S. Federal Reserve, once the lender of last resort, has become the corporate bond purchaser propping up sales and yields (> $2.3 trillion committed back in March 2020). Finally, set asides for bank consumer and corporate loans by banks may not be nearly enough as collateralized loan obligations (CLOs, not CDOs of old) held by banks may be more risky (and untested) during prolonged crisis even though the Federal Reserve and Treasury (buyers/backers of these instruments) tout their safety and soundness (as they did with CDOs back in 2007-2009). For an in-depth discussion of this, see “The Looming Banking Collapse”, The Atlantic, July/August 2020).

So, while the industry and regulators even with this “heartburn,” insist “there is nothing to see here,” the potential losses mount and the contagion spreads impacting multiple banking LOBs. However, will our digitalization efforts of the past decades and years provide the correct granularity and insight for what is coming? Have we grown complacent (as more than 90% of FSBO leadership believes they have mastered digital transformation) believing and accepting what is produced and analyzed from our extended cloud repositories as the final word? If we were to review and plan our digital strategy for the future, where would we even start? Has the profitability of a few LOBs masked unattributed risks due to a digital swagger that “we got this?” Who has quantified our “digital leverage” equations in the face of short-term prosperity surrounding by chaos and uncertainty?

The Evolving Digital Baselink

Digital transformation were, adhering to initiative goals and slogans, representing industry and enterprise programs and projects designed to eliminate paper, deliver STP (straight through processing), automation, process improvements, forecasting, householding, cross-selling and generally improve efficiencies and margins at the expense of waste and redundancy. Implicit in all these FSBO initiatives spanning the decades and costing untallied billions were quality of information, customer loyalty and insight, risk management, corporate compliance, and yes, profitability.

However, that was before the arrival of the Fourth Industrial Revolution, global health crisis, privacy and security of information (and widespread breeches), layer of innovation and cloud services, and economic chaos magnified by broken supply chains and sovereign self-interests. For FSBOs as a collective industry, their supply chains are globally linked, fueled on fungible money and often opaque to all but those who created them.

With the rise of vast data oceans, FSBOs in an “age of digital” found themselves possessing rapidly declining consumer financial information estimated to be less than 35% of transactions. FSBOs became less of a trusted source (and viewed with equal suspicion as the legal profession) post Great Recession supplanted by non-traditional firms who were not burdened with historical ideals. These newly minted competitors who started with digital and technology—there was no need to transform processes, systems, skill sets, and integrations. These new entrants had innovative thinking which was “frame separated” from dogmatic institutions who had alternative views of customer loyalty, needs, satisfaction, and capability.

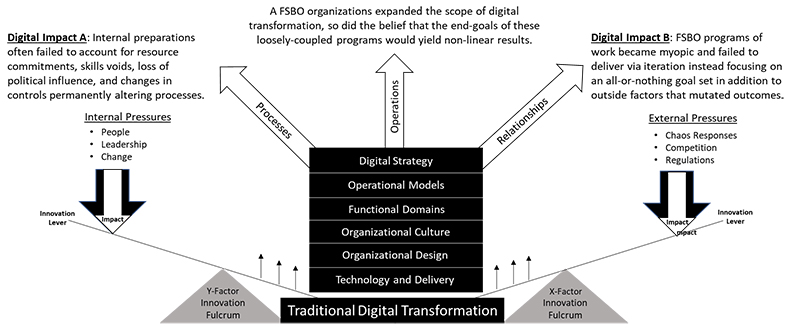

The model below segments our traditional view presented above with mitigating influences, which now must be included as a foundational given if we are to arrive at a leveraged digital transformation model that works in 2020 and beyond.

Nonetheless, questions with the above pictorial showcase what impacts the innovation fulcrums can have as they propel traditional digital transformation up and into models that are relevant and in demand by c-level leadership (to excel in their markets and demographics). The drawing begs the question, “do both the internal and external events exert similar launch pressure or do must they be skillfully balanced against iterative unknowns?” Who will filter the events of processes, operations, and relationships to arrive at achievable results—including stretch milestones? Where will the roadmaps be created and how will our extensive investments provide the runway for today—and tomorrow?

These, and many other questions, lay bare the prescriptive approaches that many digital transformation professionals fail to understand moving forward—it is not about taking a “pill” or buying into a slogan to efficiently address the forthcoming challenges. The science and discipline of digital transformation is about achieving bespoke leverage. Borrowing an idea from health sciences, we are moving from a blunt prescription of digital deliveries into one of precision delivered value propositions. For as we finish out 2020 and move into a decade of comprehensive financial disruption and risks, our future is now about digital leverage.

The Age of Digital Leverage is Here

As an industry person, you can read, reflect or dismiss the aforementioned. Afterall, if your enterprise cannot find the staff to meet demand curves, the idea that a future where being digital is analogous to the air we breathe may hold little efficacy for your challenges today. Yet, we know from experience and industry cycles, that what goes up also has an out-of-phase slope of business that if not anticipated can result in the demise of our regional FSBO, our credit union, or our community bank. The objective FDIC data alone illustrates the 5,500 institutions lost over the past 20 years who took their eyes off “what is next…” “what happens when…” or “what is my leverage to deal with the unexpected.”

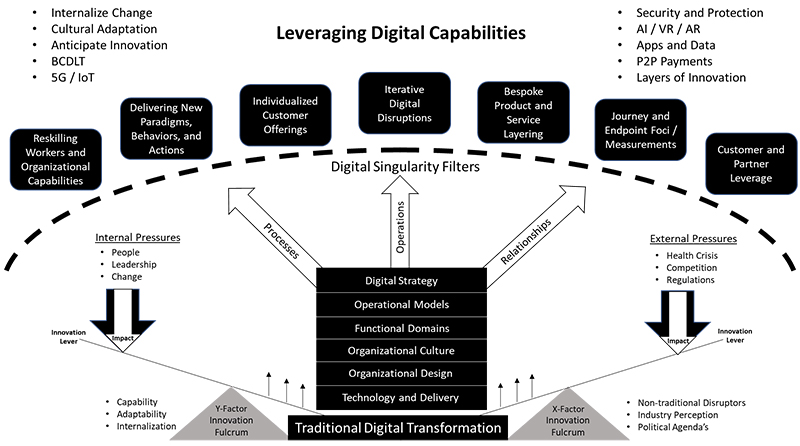

No, leveraged digital transformation is not a panacea. No amount of leveraged digital solutions will change market directions nor off-balance-sheet held securities, which are made worthless by consumer or commercial defaults, evictions, or bankruptcies. They cannot change the reality but leveraged digital approaches (like the concept diagram below) provide capabilities to detect and anticipate events as they happen—and what if, should they happen. The chaos of COVID that many influencers use to scare institutions into new software (e.g., LOS), expansive strategies, or vast temporary workforces, is just one event, one catalyst that started this decade of digital leverage. There will be more.

For executives, more than 90% believe that innovation and innovation solutions are THE focus of their corporate agendas (since they already mastered digitalization). They have assumed that the industry and their enterprise have a critical mass of digital transformation events—some consulting papers would term this a digital saturation event. And, when examined from a point-based, one-off approach that has plagued FSBOs (some of may remember the “success” associated with those enterprise data models, spanning more than 10,000 pages and costing millions), which consumed years and delivered little. For all but the largest FSBOs, digital transformations were commonly viewed as cerebral money pits that could only be launched with sufficient capital and larger risk of failure.

However, if we look at the diagram above and apply experiential lessons learned, we can visually see how new consumer demanded solutions can be incorporated by recognizing and assembling digital solutions in layers and using leveraged offerings (moving into iterations and away from big-bang implementations). As FSBO leaders, the idea and programs that incorporate digital leverage also benefits partners, our non-industry touchpoints, and builds core competencies (with sufficient skill sets) to not just compete, but to lead markets with continuous innovation. In the end, digital leverage is not about throwing away what we have done with one generation of innovation to move into another, it is about anticipating and influencing incremental and disruptive events.

Using the exponential explosion of consumer and business connected devices (projected to exceed 70 billion by 2025, up from 7 billion today), the demand to leverage digital data and encapsulated assets can only be feasible if the approach abandons the “lift-and-shift” ideas that dominated technology and systems for the last two decades. So where do you begin? What is the process of implementing a digital leverage initiative in an age of innovation acceleration?

Digital Leverage Cannot Be Implicit

Let us set forth a rudimentary plan of attack to frame digital leverage. First, digital leverage begins with defining the end-state—what you want from those traditional digital initiatives that focused on single layer or LOB offerings? Sounds simple, but it frequently involves business model adjustments and iterative roadmaps that align to the customer rather than the traditional approach being aligned with investors.

Secondly, if the data is digitized, how can this be compartmentalized and segmented to create building blocks of value that can also be less-invasively replaced or combined as new information and technologies become available. Think of it this way, if you only had 10 building blocks as a child to create words or a structure, you were limited. However, what if we gave you 732 that could be combined into a vocabulary, into a shape or into an architecture that can be adaptable as innovations progress? Moreover, what if we were to give you access to your friends building blocks that you did not own but we allowed to use as a repository of “options”? Now you can start to see the potential of digital leverage.

And finally, how ready is your organization, your management and your team to not only plan for digital leverage, but to organize, delver, iterate and fail, moving forward? Can you remove yourself and your FSBO from the dogmatic frame of reference to think innovatively, execute non-linearly, and assemble and transform technologies and partnerships? Yes, the third step requires that you assemble, disassemble, and remake on a continual improvement, iterative cycle digital leveraging compartments using orchestration—where you are the conductor accountable and responsible for the outcomes.

Sound far-fetched, academic or too complex? This is actually the world you deliver into today as part of an FSBO whether you are delivering customer service, running networking or technology segments, building and integrating back office solutions, or on the front lines managing loans and risks. And therein lies the largest problem when disruption hits FSBOs—recognizing the events before they arrive, before competitors seize the initiative, and before, in a worst case scenario, your enterprise becomes one of the 250 regulated financial institutions whose brands no longer exist each and every year.

The leverage of all things digital is here. As world events unfold and financial supply chain contagion starts to impact your business, how will you leverage your digital empire to meet what is coming in the markets, with consumers, and from regulators? Indeed, it is about digital leverage (or as I like to say, d.LEVERAGE).

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)