Spring Initial Unemployment Claims Top 30 Million

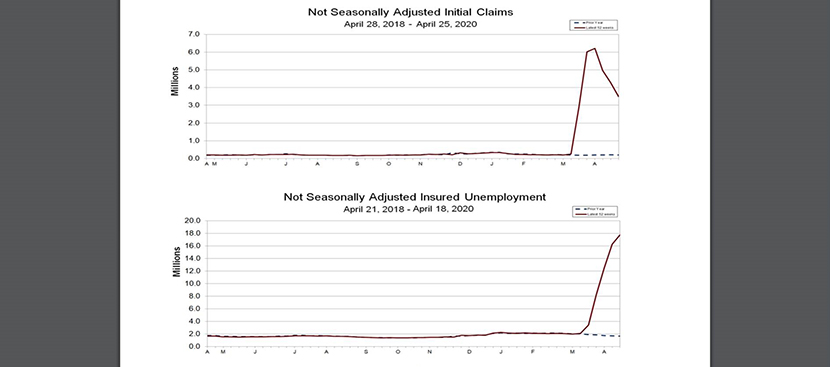

Americans filed 3.8 million new unemployment claims last week, the Labor Department reported yesterday, bringing the six-week total to more than 30 million—nearly one-fifth of the entire U.S. workforce.

The report covers the week ending Apr. 25.

Labor said seasonally adjusted initial claims represented a decrease of 603,000 from the previous week’s revised level. The four-week moving average fell to 5.033 million, a decrease of 757,000 from the previous week’s revised average.

The report said the advance seasonally adjusted insured unemployment rate rose to 12.4 percent for the week ending April 18, an increase of 1.5 percentage points from the previous week’s revised rate. This marks the highest level of the seasonally adjusted insured unemployment rate in the history of the seasonally adjusted series.

Furthermore, the advance number for seasonally adjusted insured unemployment during the week ending April 18 rose to 17.992 million, an increase of 2.174 million from the previous week’s revised level. This marks the highest level of seasonally adjusted insured unemployment in the history of the seasonally adjusted series.

“As states begin the process of reopening and Americans return to work, today’s unemployment report reflects once again the hardship caused by the coronavirus pandemic,” said Secretary of Labor Eugene Scalia. “Looking ahead, as workplaces reopen, we must ensure that individuals transition from unemployment back into the workforce.

Analysts said the number of Americans who have lost their jobs because of the coronavirus pandemic could still be “understated.” Congressional Budget Office projections suggest the unemployment rate could reach 16 percent in the current (second) quarter and remain above the 10-percent high during the Great Recession through 2021.

“The weekly initial unemployment claims data are one of the best examples of just how quickly the economy went from firing on all cylinders to being parked on the side of the road,” said Mark Vitner, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “Prior to the COVID-19 outbreak, jobless claims had been hovering at their lowest levels since the late 1960s, when the economy and labor force were a fraction of their size today. In just six weeks we have seen jobless claims hit their highest levels ever. A disproportionate share of claims have come from hourly workers, as restaurants, hotels, amusement attractions, doctor’s offices, customer service centers and assembly lines shut down.”

Vitner noted normally, unemployment claims do not translate into an equal number of unemployed in the monthly employment report because the labor market is constantly in flux and many losing a job find a new one. “Today, however, with much of the economy shutdown, there are fewer opportunities for displaced workers to find a new job,” he said. “As a result, a much higher proportion of those losing jobs and filing unemployment claims are likely to show up as unemployed in the monthly data, yielding an unprecedented spike in the unemployment rate.”

“Claims still remain at historically elevated levels, and continue to illustrate the high degree of labor market disruption being registered via reduced economic activity and falling consumer confidence,” said Doug Duncan, chief economist with Fannie Mae, Washington, D.C. “As with the prior weeks, a few caveats make this week’s data difficult to interpret precisely. On one hand, [unemployment insurance] eligibility rules have been relaxed recently, increasing the number of people who are able to apply. This makes it difficult to estimate the uninsured unemployed share of the workforce. On the other hand, many states reported a significant backlog of UI applications due to a lack of processing capacity, indicating that this week’s release may understate the true extent of insured layoffs.”