MBA Chart of the Week: IMB Quarterly Pre-Tax Net Production Profits

Source: MBA’s Quarterly Mortgage Bankers Performance Report; www.mba.org/performancereport.

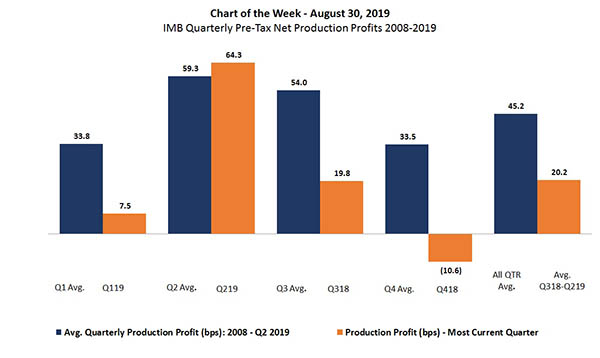

Seasonality is part of the mortgage business. Based on MBA’s Quarterly Mortgage Bankers Performance Report (the second quarter 2019 report was released this week), independent mortgage banks tend to have higher profitability in the second and third quarters of the year because of the onset of the spring home buying season and subsequent increase in purchase volume.

This week’s chart shows pre-tax production profits for independent mortgage banks averaged 64.3 basis points in the second quarter, the best MBA has seen since third quarter 2016. This result was 19.1 basis points above the average across all quarters and 5.0 basis points above the average across all second quarters since inception of the study in 2008. Higher production volume and lower expenses were key factors in this positive outcome.

The second quarter provided a much-needed boost to IMB profitability. In the previous three quarters, net production profits were significantly lower than their historical quarterly averages. For example, despite the favorable seasonality, net production profit in the third quarter of 2018 was only 19.8 basis points, compared to the historical third quarter average of 54.0 basis points.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Jenny Masoud is associate director of analytics with MBA; she can be reached at jmasoud@mba.org.)