MBA Chart of the Week: Commercial/Multifamily Originations Forecast

Source: MBA Commercial/Multifamily Real Estate Finance Forecast.

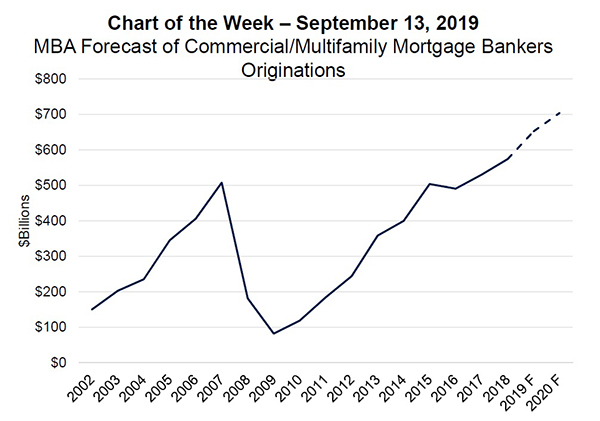

The Mortgage Bankers Association forecasts commercial and multifamily mortgage bankers will close a record $652 billion of loans backed by income-producing properties this year, 14 percent higher than last year’s record volume ($574 billion).

Total multifamily lending, which includes some loans made by small and midsize banks not captured in the overall total, is forecast to rise to $359 billion, also a record and 6 percent higher than last year’s record total ($339 billion). MBA anticipates volumes will rise again in 2020, reaching $700 billion in commercial/multifamily mortgage bankers’ originations, and $390 billion in total multifamily lending.

The low interest rate environment, coupled with still-strong demand for commercial and multifamily assets, has pushed property values higher and increased demand for mortgages. At the beginning of the year, many economists, investors and others anticipated long-terms rates would currently be in the 3 percent range and rising–potentially putting pressure on property values and decreasing demand for debt. Instead, the 10-year Treasury yield is at approximately 1.7 percent, and many market participants are planning for rates to remain “lower for longer.” The result is heightened demand and higher volumes.

MBA’s forecast is higher than its previous projections, driven by the lower interest rates and favorable market conditions, as well as by a re-benchmarking of the size of the multifamily lending market. Based on recently released data, banks lent considerably more in multifamily mortgages in 2018 than previous estimated, making more than $100 billion in multifamily loans.

MBA commercial/multifamily members can download a copy of MBA’s Commercial/Multifamily Real Estate Finance Forecast at www.mba.org/crefresearch.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org.)