Dealmaker: George Smith Partners Secures $18M in Bridge Financing

George Smith Partners, Los Angeles, secured $17.6 million in bridge loans for a three-building Los Angeles-area portfolio.

GSP’s advisors on the deal included Principal Antonio Hachem, Senior Vice President Loren Bedolla, Vice President Wendy Wang, Vice President Michael Leahey and Assistant Vice President John Choi.

“Despite the strength and experience of the sponsor, we faced four major issues in obtaining financing,” GSP said. “The first challenge was unresolved past title issues. The second challenge we were up against was maturing interim loans. Next, due to the high volume of projects in the city of Los Angeles, power connection to one of our sites was delayed. Lastly, the initial financing request was for 85 percent loan-to-cost. After our full analysis, we discovered that the financing needed to pay off existing liens and provide the working capital needed for a successful execution was closer to 100 percent loan-to-cost.”

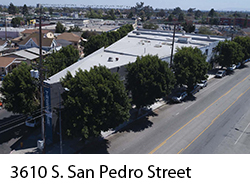

Private balance sheet lender Columbia Pacific Advisors, Seattle, provided bridge loans for the full capital stack. The 12-month interest-only loans included two six-month extension options and priced at 10 percent. The financing allowed the sponsor to acquire 3610 S. San Pedro Street, a 1940’s-vintage 43,000-square-foot creative office building in downtown Los Angeles and to reposition two retail buildings in the San Fernando Valley and in south Los Angeles.

Private balance sheet lender Columbia Pacific Advisors, Seattle, provided bridge loans for the full capital stack. The 12-month interest-only loans included two six-month extension options and priced at 10 percent. The financing allowed the sponsor to acquire 3610 S. San Pedro Street, a 1940’s-vintage 43,000-square-foot creative office building in downtown Los Angeles and to reposition two retail buildings in the San Fernando Valley and in south Los Angeles.

Columbia Pacific Advisors Senior Vice President of Originations Will Nelson noted all three transactions closed within 10 days of working out the problems with the previous lender.