MBA Chart of the Week: Refinance Application Trends by Loan Size

Source: MBA Weekly Applications Survey; Monthly Profile of Mortgage Activity.

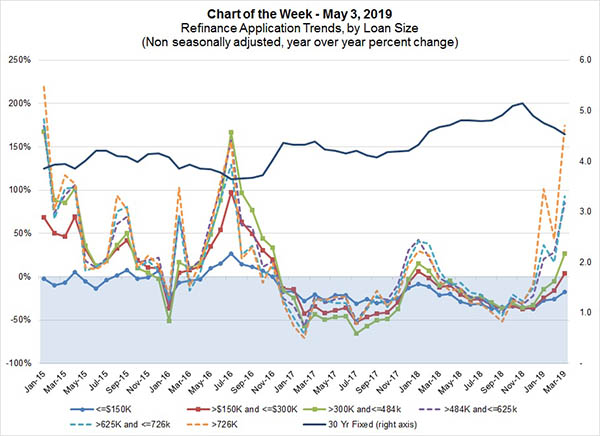

This week’s chart highlights the differential response of refinance applications to the recent decline in mortgage rates.

As mortgage rates decreased by 80 basis points from a recent high in November (from 5.17 percent to a recent low of 4.36 percent), we saw a pickup in refinance activity. However, this was heavily driven by borrowers with high loan balances, specifically above $300,000, and most significantly in the greater than $726,000 price category.

As a result, we saw up to triple-digit percentage increases in refinance applications compared to the same month in 2018, and the average loan size on a refinance application jumped to $438,900 in late March, after averaging $263,900 in 2018.

Borrowers with higher loan balances tend to be more sensitive to rate changes, and this was clear in the increases. However, the last time we saw a similar rally in refinances in 2016, the response was more even across the loan size categories, with only the lowest tier lagging the others. This was an indication of how many borrowers had already secured mortgages with rates in the 4 percent range this decade, and only borrowers with the largest loan amounts saw a benefit to refinancing this time around.

More recently, rates have risen by six basis points and refinance applications have decreased by 31 percent over the period, with average loan balances dropping back down to $312,000. Although the temporary boost to refinances has dissipated, lower mortgage rates will help to support growth in purchase activity heading into the summer.

(Joel Kan is associate vice president of economic and industry forecasting with MBA; he can be reached at jkan@mba.org.)