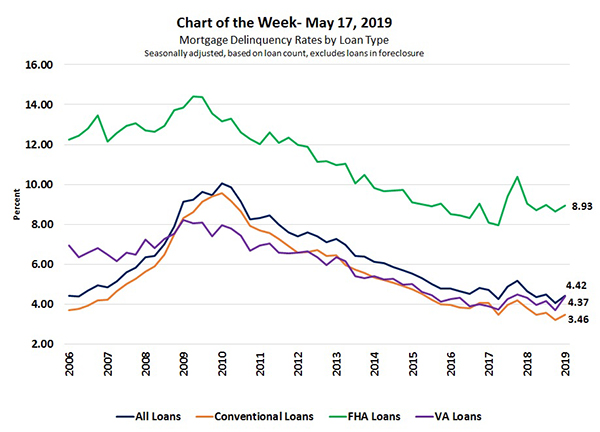

MBA Chart of the Week: Mortgage Delinquency Rates by Loan Type

Source: Mortgage Bankers Association National Delinquency Survey.

MBA Research last week released first quarter 2019 results of its National Delinquency Survey.

The overall delinquency rate rose from an 18-year low, to a seasonally adjusted rate of 4.42 percent. By loan type, the total delinquency rate for conventional loans increased by 27 basis points to 3.46 percent compared to the fourth quarter. The FHA delinquency rate increased by 28 basis points to 8.93 percent, while the VA delinquency rate increased by 66 basis points to 4.37 percent.

Despite the quarterly uptick of 36 basis points, the overall delinquency rate was still down 21 basis points from one year ago. This is another sign of the very strong economic environment, bolstered by low unemployment and rising wage growth. Moreover, the serious delinquency rate–the percentage of loans that are 90 days or more past due or in the process of foreclosure–dropped across all loan types from the previous quarter and a year ago to its lowest overall level since second quarter 2006. Additionally, the foreclosure inventory rate of 0.92 percent was at its lowest level since fourth quarter 1995.

For more information about the MBA National Delinquency Survey, click https://www.mba.org/news-research-and-resources/research-and-economics/single-family-research/national-delinquency-survey.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Anh Doan is senior financial analyst with MBA. She can be reached at adoan@mortgagebankers.org.)