MBA Chart of the Week: Low-to-Moderate Income Originations by Company Type

Source: Home Mortgage Disclosure Act data, 2007-2017.

Many are aware that independent mortgage banks have accounted for the majority of mortgage origination volume the past few years.

Different types of lenders have typically served various portions of the market. IMBs have generally been more focused on purchase lending, especially through the government lending programs, while banks have tended to have a higher share of adjustable-rate mortgages, jumbo loans and other loans held in their portfolios.

In 2017, IMBs accounted for more than 80 percent of Federal Housing Administration loans, 70 percent of Veterans Affairs loans and 64 percent of loans guaranteed by U.S. Department of Agricultural Rural Housing Service loans.

In today’s mortgage market, which is now predominantly purchase originations and includes a large and growing number of first-time homebuyers, it is thus not surprising to see the IMB market share increase. Moreover, 64 percent of minority homebuyers in 2017 obtained their financing from an IMB.

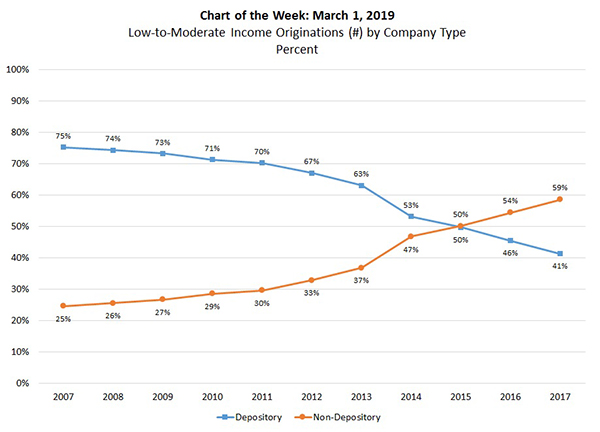

The Chart of the Week highlights these trends, by showing the share of low-to-moderate income originations (by counts) for depository institutions and IMBs, with low-to-moderate income defined as having an income less than 80 percent of the FFIEC Median Family Income designated for that tract. As shown, the IMB share of this portion of the market grew from 54 percent to 59 percent in 2017.

With first-time buyer demand expected to remain strong in the year ahead, IMBs will likely continue to lead the way in providing financing to aspiring homeowners.

(Mike Fratantoni is chief economist and senior vice president of research and economics with the Mortgage Bankers Association. He can be reached at mfratantoni@mba.org. Anh Doan is senior financial analyst with MBA. She can be reached at adoan@mortgagebankers.org.)