MBA Chart of the Week: Ways Borrowers Remit Mortgage Payments

Source: MBA Servicing Operations Study and Forum www.mba.org/sosf.

MBA hosted its annual National Servicing Conference & Expo last month in Orlando, Fla. Among topics discussed were challenges and opportunities that mortgage servicers face with the end of the “one-size-fits-all” customer service model.

Servicers must be nimble in providing services that customers want, and in doing so, they retain promise of a future refinance, purchase loan, or cross-sell opportunity.

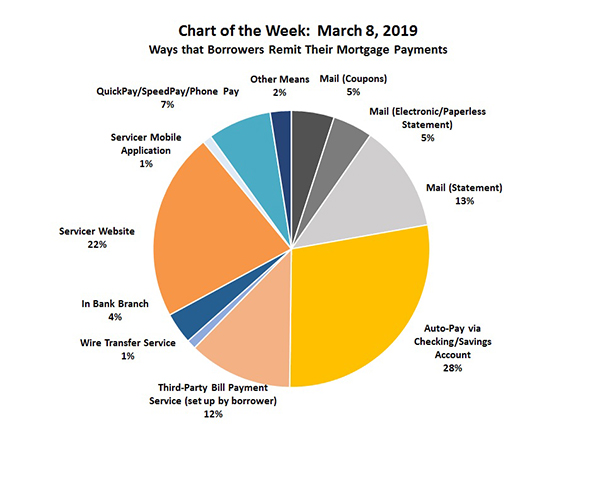

This week’s chart, showing the myriad options for remitting payments, provides a glimpse into operational complexities that may arise for mortgage servicers from the fundamental task of collecting payments. Auto-pay is the most prevalent and arguably the “cleanest” form of remittance for mortgage servicers, averaging 28 percent of remittances. Payments via mail comprise 23 percent of remittances, yet the method of communicating payment amount to borrowers is split between coupons, statements and e-statements. An emerging remittance method is third-party bill payment services (12 percent).

Third-party payment services offer borrowers more control than auto-pay, but may result in payment complications when the escrow amount changes or an adjustable rate loan re-sets. On the lowest end of options, servicer mobile applications are emerging, and poised to gain remittance share in the future. For now, they only represent about 1 percent of borrower remittances.

(Marina Walsh is vice president of analysis with MBA; she can be reached at mwalsh@mba.org.)