Dealmaker: George Smith Partners Arranges $30M

George Smith Partners, Los Angeles, arranged $30.4 million in bridge financing for office and retail assets in two states.

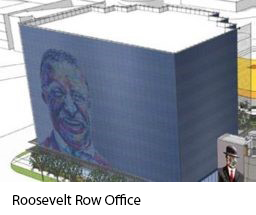

In Arizona, the firm secured $22 million to reposition a 100,000-square-foot office building and 334-stall parking garage in Phoenix’s Roosevelt Row Arts District. The building’s main tenant recently vacated, leaving the property with low occupancy. But the sponsor acquired the asset with letters of intent from several large new tenants and plans to reposition and stabilize the remainder of the property after executing the leases shortly thereafter.

In Arizona, the firm secured $22 million to reposition a 100,000-square-foot office building and 334-stall parking garage in Phoenix’s Roosevelt Row Arts District. The building’s main tenant recently vacated, leaving the property with low occupancy. But the sponsor acquired the asset with letters of intent from several large new tenants and plans to reposition and stabilize the remainder of the property after executing the leases shortly thereafter.

A team led by GSP Principal/Managing Director Malcolm Davies secured the non-recourse financing. Sized at 70 percent of total project costs, the loan included a future funding facility to cover tenant improvements and leasing commissions. The two-year with a one-year extension option floats at the 30-Day LIBOR plus 6.85 percent and funded within three weeks of application.

GSP also secured $8.4 million in bridge financing for the lease-up of a two-tenant retail center in Greeley, Colo. The borrower recently leased a 50,000-square-foot space to a national fitness center. The new 10-year lease, which carried a corporate guaranty, required a large tenant improvement package. Loan proceeds refinanced the existing loan and funded leasing costs without requiring the sponsor to bring in any additional equity.

The center’s other tenant, a national retailer, agreed to extend its lease term to 10 years at the same time to eliminate any rollover risk.

GSP Principal/Co-Founder Steve Bram and Vice President Patrick O’Donnell found a capital source that understood the tenants’ value to Greeley’s market, making the lender comfortable with the completed value of the center.

The non-recourse financing was sized to 75 percent of cost and priced at the one-month LIBOR plus 4.25 percent.