MBA Chart of the Week: IMB Revenue/Expense

Source: MBA Quarterly Mortgage Bankers Performance Report.

Production profitability for independent mortgage banks increased to 7.5 basis points–$285 per loan–in the first quarter, from a reported loss of 11 bps ($200 per loan) in the fourth quarter, according to the MBA Quarterly Mortgage Bankers Performance Report released last week (https://www.mba.org/news-research-and-resources/research-and-economics/single-family-research/mortgage-bankers-performance-reports-quarterly-and-annual).

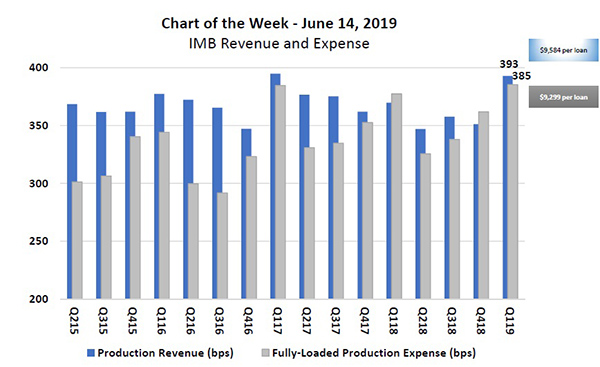

The Chart of the Week shows how production revenues and expenses contributed to the bottom line. In the first quarter, revenues per loan rose to a study high, mitigating the increase in per-loan production expenses, also a study high.

Total production revenue (fee income, net secondary marking income and warehouse spread) increased to 393 bps ($9,584 per loan) in the first quarter, up from 351 bps ($8,411 per loan) in the fourth quarter. Total loan production expenses–commissions, compensation, occupancy, equipment and other production expenses and corporate allocations–increased to 385 bps ($9,299 per loan) in the first quarter, up from 362 bps ($8,611 per loan) in the fourth quarter.

Looking ahead, while there is no clear cyclical pattern for production revenues over the past four years, expenses have typically dropped to annual lows in the second quarter from previous first quarter peaks.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Jenny Masoud is associate director of analytics with MBA; she can be reached at jmasoud@mba.org.)