MBA Chart of the Week: Cash Share, Home Sales & Purchase Mortgage Applications

Source: National Association of Realtors data with MBA calculations, MBA Weekly Applications Survey.

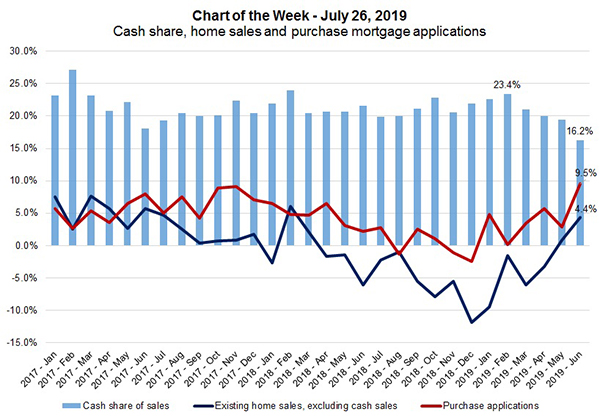

Existing home sales declined 2.2 percent in June, and have been consistently weak this year. However, this trend has not always been consistent with other housing market indicators. One candidate for this divergence is that cash buyers have been less active in the housing market this year.

This week’s chart highlights the cash share of existing sales, the annual change in existing sales excluding cash sales and the annual change in home purchase mortgage applications. Since February, there has been a decrease in the cash share of home sales from 23 percent to 16 percent last month.

The cash share, which is from the Realtors Confidence Index survey, has averaged 25 percent between 2008 and June 2019. We used the cash share data to approximate the year-over-year change in existing-home sales (excluding cash transactions)–a proxy for home sales financed with a mortgage, and compared the series to the annual change in purchase mortgage applications.

The decline in the cash share coincides with a period of stronger growth in other measures of purchase activity, both for the adjusted home sales measure and for purchase applications. Both series were at a recent low in December 2018, but have generally trended higher since then. The most recent data point last month shows year-over-year growth of 9.5 percent in purchase applications and 4.4 percent for existing-home sales (excluding cash sales). As more millennials enter the market, these first-time buyers are quite likely to be financing, and not be cash buyers. So it is not surprising that we are seeing financed purchase activity increase, even as investors are stepping away from the market.

These recent trends are likely also related to a declining investor share of home sales, along with another NAR report (https://www.nar.realtor/research-and-statistics/research-reports/profile-of-international-activity-in-u-s-residential-real-estate) showing fewer international buyers in the housing market. International buyers have historically had a higher share of all-cash transactions.

(Mike Fratantoni is chief economist and senior vice president of research and economics with the Mortgage Bankers Association. He can be reached at mfratantoni@mba.org. Joel Kan is associate vice president of economic and industry forecasting with MBA; he can be reached at jkan@mba.org.)