MBA Chart of the Week: Components of Cost to Originate in Retail Production Channel

Source: PGR: MBA and STRATMOR Peer Group Roundtables; www.mba.org/pgr.

The cost to originate a loan in the retail production channel (excludes third-party and consumer direct originations) averaged about $10,200 in 2018, based on a cross-section of 78 lenders, including mid-size and large banks and independent mortgage companies. But there are key differences among these lenders in terms of operating model, geography, product mix and sales strategy.

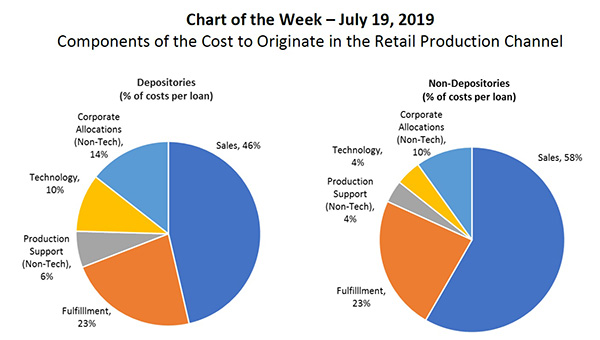

So in this week’s chart, we take a different approach and examine the major components of the cost to originate as a share of the total costs, broken out between depositories and non-depositories.

For depositories, 46% of retail origination costs are used to cover sales functions, versus 58% for non-depositories. Fulfillment costs as a share of overall costs is flat between depositories and non-depositories at 23%, and differences in production support are negligible. Both technology and corporate cost shares are higher for depositories at 10% and 14%, compared to 4% and 10% for non-depositories.

Sales costs include expenses for loan officers, loan officer assistants, other sales managers and staffs, marketing, sales office leases, etc. Fulfillment costs include processing, underwriting, closing and other functions necessary to close a loan. Technology includes point-of-sale and loan origination systems, network technology and help desk. Production support (non-tech) includes post-closing, secondary, quality control and credit policy. Corporate costs include executive management, legal, human resources, corporate finance and parent allocations.

For more information, contact Marina Walsh at mwalsh@mba.org.