MBA Chart of the Week: Recent Originations and Forecast

Source: MBA Forecast.

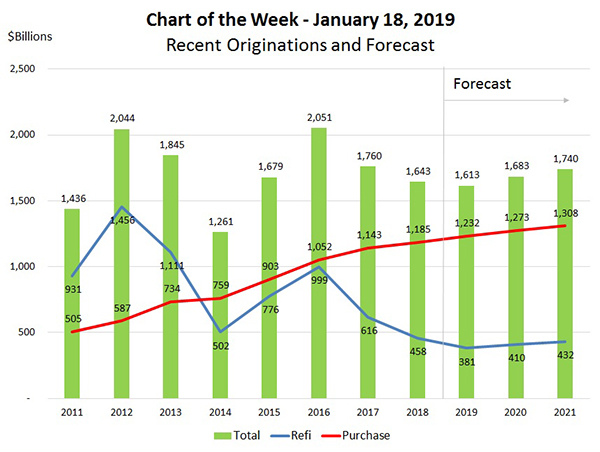

Our chart this week highlights MBA’s current forecast for mortgage originations for 2019 through 2021.

We expect overall origination volume to decline slightly in 2019, but then grow in 2020 and 2021. Purchase originations are forecast to increase 4 percent in 2019 and 3 percent in both 2020 and 2021.

In the year ahead, we see risks from the ongoing government shutdown, slowing global growth, trade wars, Brexit, a more patient Fed and a volatile stock market. However, if rates stay low, housing inventory continues to grow and the job market maintains its strength, we still expect to see a solid spring market.

While weekly data can be volatile, our most recent data on purchase applications showed an 11 percent gain in purchase volume compared to the same week last year. Furthermore, the two weeks of growth coming out of the typically slow holiday season and the still strong job market have us guardedly optimistic regarding home buying activity in the coming months.

In terms of refinance activity, while our forecast is for a decrease in 2019, borrowers with larger loans tend to be more responsive to a given drop in mortgage rates, and we are seeing that so far early in the year, as the average loan balance for refinance applications hit an all-time high. Borrowers with jumbo loans are also more apt to take ARMs as opposed to fixed-rate loans. Thus, it was not surprising to see the ARM share last week at its highest level since 2014.

(Joel Kan is associate vice president of economic and industry forecasting with MBA; he can be reached at jkan@mba.org.)