MBA Chart of the Week: Mortgage Delinquency Rate and Unemployment Rate

Source: MBA National Delinquency Survey (www.mba.org/nds); Bureau of Labor Statistics.

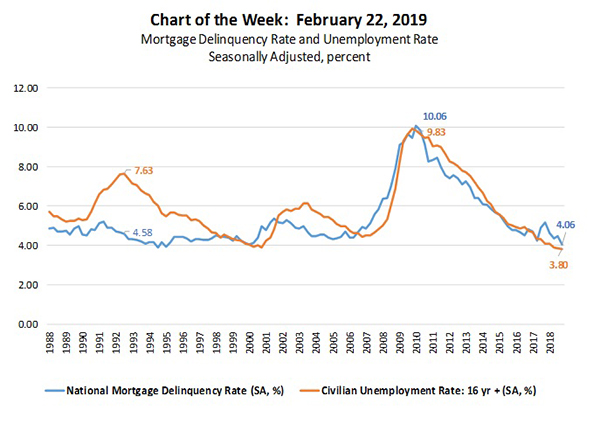

Last week, MBA Research released fourth quarter results of its National Delinquency Survey. In this week’s chart, we show the relationship between the unemployment rate, supplied by the Bureau of Labor Statistics, and the mortgage delinquency rate for all loans over a 30-year period.

MBA reported the delinquency rate for mortgage loans on one-to-four-unit residential properties fell to 4.06 percent–down 41 basis points from the previous quarter and 111 basis points from a year ago to its lowest level since first quarter 2000.

Nine years ago (first quarter 2010) during the aftermath of the Great Recession, the unemployment rate reached 9.83 percent and the mortgage delinquency rate was at its peak of 10.06 percent. Fast forward to last year’s fourth quarter, the unemployment rate was 3.80 percent and nearing 50-year lows, and the mortgage delinquency rate (4.06 percent) fell to an 18-year low.

The close tracking between unemployment and mortgage delinquency rates from 1988-2008 appears less pronounced than from 2008-2018. For example, the unemployment rate reached 7.63 percent in third quarter 1992, while the mortgage delinquency rate was relatively low in comparison, at 4.58 percent. Possible factors influencing this change include differences in mortgage product mix and criteria, borrower behavior and recession severity.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Joel Kan is associate vice president of surveys and forecasts with MBA; he can be reached at jkan@mortgagebankers.org. Anh Doan is senior financial analyst with MBA. She can be reached at adoan@mortgagebankers.org.)