MBA Chart of the Week: GDP, Inflation and the Fed Funds Rate

Sources: U.S. Bureau of Economic Analysis, U.S. Bureau of Labor Statistics, Federal Reserve.

In an effort to insure against a further slowdown in the economy and the risk of a trade war, the Federal Open Market Committee voted July 31 to cut its target rate by 25 basis points, and moved to halt shrinking of its balance sheet in August, rather than later this fall.

The rate cut was clearly telegraphed in advance, and was fully priced into mortgage rates. However, the Fed continues to try to interpret conflicting signals from the economic data–global economic growth continues to weaken but the job market and consumer spending data remain strong. Additionally, inflation ticked up a bit in June.

The statement, and Chairman Jerome Powell’s comments in his press conference, signaled that the Fed will continue to be data-dependent; that the outlook for the U.S. was still “favorable;” and that this cut does not lock them into a path of future rate cuts. He termed it as a “mid-cycle adjustment to policy,” not the beginning of a confirmed set of rate cuts. However, we expect they will lower rates once more this year and once in 2020. By that point, this period of weakness in global growth should have passed.

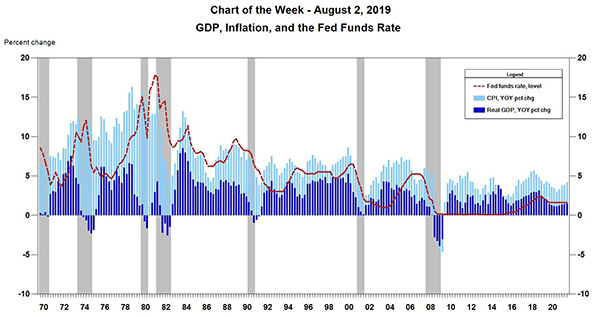

This week’s chart shows the relative level of the fed funds rate compared to growth and inflation. The chart includes our forecast for a slowdown in economic growth in 2019 and 2020, along with two additional rate cuts. After those rate cuts, we expect the Fed to hold rates at that level until growth (or inflation) starts to pick up again. Prior to the last recession, the fed funds rate generally followed the sum of growth and inflation, but following that recession we have been in a period of low rates, even after the last bout of rate hikes in recent years.

Our forecast is for mortgage rates to hold steady in the neighborhood of 4 percent over the next few years. This should provide ongoing support for home buyers, increasing affordability, particularly in light of the slower pace of home price growth we have seen thus far this year.

(Mike Fratantoni is chief economist and senior vice president of research and economics with the Mortgage Bankers Association. He can be reached at mfratantoni@mba.org. Joel Kan is associate vice president of economic and industry forecasting with MBA; he can be reached at jkan@mba.org.)